Life Insurance Agent Reviews One America Are They Worth Working With

Welcome back to Coaching Corner. Today, we delve into the strengths of One America, a well-regarded insurance company known for its innovation and flexibility. Joining us is our product specialist, Alden Armstrong, who will walk us through what makes One America a top choice for many.

Why We Love One America

One America stands out in several key areas:

- Stellar financial ratings and a conservative investment portfolio

- Excellent handling of cash value policies

- Innovative long-term care solutions

Key Strengths of One America

- Front Loading Flexibility

One America is ideal for those who wish to deploy significant cash into life insurance without hefty premiums. Perfect for entrepreneurs, investors, or families who have cash reserves and need flexible premium options.

- Leading in Long-Term Care

One America has pioneered products that address long-term care needs effectively, recognizing that a substantial portion of those over 65 will require such care.

- Accelerated Underwriting

For policies of this magnitude, One America's ability to expedite underwriting processes from the typical 6-10 weeks down to as little as 2-4 weeks is remarkable.

Deep Dive Example

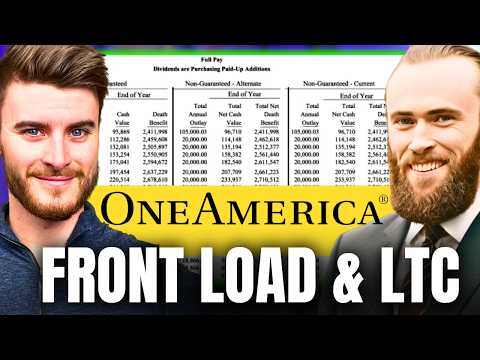

Let's explore an example for a 40-year-old male seeking a policy. The first-year investment is $105,000 with a potential cash value of 93% after the first year. From year two, the premium drops to $20,000 and maintains financial growth with a minimum premium of $5,000.

Here's why this is compelling:

- High first-year cash value

- Flexibility in premium payments

- Term writers available to adjust policy efficiencies

Handling Long-Term Care with One America

With long-term care needs projected for 70% of individuals over 65, One America provides a compelling alternative to traditional income annuities.

For example, an index annuity care product targeted at long-term care provides an incredible safety net over conventional methods like deferred income annuities, which have limitations if lifespan predictions are unmet.

Conclusion

One America shines for those seeking robust insurance and long-term care solutions. Their flexibility, accelerated processes, and comprehensive coverage options make them an excellent choice for many. If you're considering adapting your insurance strategy, reach out to us.

Schedule a 15-minute Clarity CallFull Transcript

Hey guys, welcome back to Coaching Corner. I'm here with our product specialist, Alden Armstrong, who made his YouTube debut a couple months ago and was a huge hit. We got a lot of you asking about different insurance companies. Many of you have said, hey, I would love for you to talk about One America. I would love for you to talk about One America. I would love for you to talk about One America. And so we are talking about One America and we're just going to give like the overview. I'll be first to say, I really, really, really love One America as an insurance company. They have solid ratings. They have incredible people. And I've really enjoyed as a company. We represent lots of different carriers. And it's important to have multiple carriers that you represent because not every carrier is going to excel in everyone's strategy. And One America has some incredible areas where they excel at. And we want to very much highlight that. And so we're going to be talking about really two things in general. And then I'm going to hand it over to the product specialist himself all then. But One America excels at front loading. We're a big fan of people that who are sitting on cash, whether entrepreneurs, investors, or even families that are just like, stat, like holding on to cash and they want to put it into life insurance, but they don't want huge premiums. They want flexibility going forward. One America is a phenomenal fit for that. And then also they are leading the way when it comes to long-term care. And so we're going to talk about two examples as relates to that. Without further ado, all then welcome back and pumped for this video, man. Let's get after it. Well, guys, thank you so much again for having me on the show. We're going to dive into One America like Caleb said. Now that there's four points I want to bring up very quickly here with One America. This is areas that they excel in. First of all, as Caleb mentioned, amazing company, great people to work with. We've had a great experiences with them so far in our time working with this company, but they're also highly conservative when it comes to their investment portfolio. There's a lot of insurance companies out there that get, I don't want to say risky, but they don't take as much in depth look at what they're investing in because they are chasing returns, right? So the mutual companies that we pick, we want to pick the ones that are very conservative that have a high degree of financial backing and their financial ratings are very, very strong. One America is definitely a part of that team. Now, secondarily, Caleb mentioned front loads. I'm going to caveat that. Front loads specifically under 100,000 with his carrier are incredible. Very, very high degree of cash value in the first year, usually between 90 to 95%, which is amazing. Long-term care, we're going to look at that toward the end of the video. They're leading the way in a lot of ways with that particular product. And then this is the reason that we have started doing more business with one America recently, accelerated underwriting. Only a few carriers in this industry have the ability to do accelerated underwriting. On average, underwriting can take six to 10 weeks, or some people it takes longer, and I'm sorry about that, but that's just life, for some people it's quicker, but that's the average. Accelerating underwriting can get us through the process in two to three, sometimes two to four weeks, which is absolutely incredible. So without further ado, let's jump into some specific numbers here. As you can see on my screen, we're looking at a male who is 40 years old, and we're assuming a preferred non-tabacco rating. This policy that you can see here as well is not a mech. We're building the death benefit high enough to be able to get a lot of cash into it without getting the IRS involved, which is of course everyone's favorite thing not to do. So coming down to the illustration, we're putting in $105,000 the very first year of this policy, total annual premium, right? If you look over the far right hand side for total net cash value, this is an end of year value that does include the dividend. If you do the math here, it's around 93% of cash value in the very first year after the dividend is paid. That's insane. It's very, very solid. We really like that. The second year in this front load strategy, we dropped that premium to 20,000. 20,000 is going to continue to fund this policy at a very high degree, give you a lot of cash value growth year over year, and also maintain that compound effect that we get when we put dollars into life insurance, which is really, really powerful. Now, Kayla, before you asked me, because you always asked me, what's the minimum premium? The minimum premium of this policy is $5,000. That's partly reason I built this the way that I did to show you're putting in $100,000 of effectively extra premium, and then you pay that at additional five grand right there. Starting this second year, that minimum premium doesn't change. That's the beauty about life insurance in the way that we build it with whole life. That's going to be the workhorse and the spine, if you will, of this insurance policy. That base premium does create cash value. All the life insurance carriers we work with base premium creates cash value. Don't let anybody on YouTube tell you it doesn't. The difference is it just shows up more slowly. Hated conditions is the gas. It gives us a lot more cash value much more quickly. I want to pause here for a moment, giving you some of the highlights. Kayla, do you have any questions you want me to speak to? No, I just think it's really, I love front loads because we're giving lots of early cash. You're not putting people on the hook for huge premiums. I see that there's 20,000 from year two to 10, but the reality is 5,000 is the minimum. I just acknowledge that this is great. I have a question at the end that I'll ask about what's the smallest front load you would do with one America. So someone might say, I don't know, 100,000, but I might be sitting on 30 grand. What does that look like? But you can answer that at the end overall tracking with you. Perfect. Well, I'll touch on two things very quickly here. Kayla mentioned that we're doing $20,000 a year up until year 10, and then that number changes. What's up with that? In order to justify the ability to put in six figures into this policy the very first year, we have to buy some aspect of death benefit. And we want to do that as cheap as possible to make the efficiency of the policy as great as possible. We're using a 10 year termwriter. So that termwriter elevates the death benefit, allows us room to shove a bunch of cash into. And then as soon as we don't need it anymore, we drop it off. Now, your situation may be different, right? Maybe you're a 40 year old man, you get a two year old at home. I may build your policy after we talk with a 20 year termwriter because you want to make sure that that kid is protected. So this is very customizable from, but from an efficiency standpoint, dropping it off at year 10 means we now have less drag, right? Less cost associated with this policy. And now we can just focus on building those cash value dollars much more quickly. That's why you also see that drop in death benefit. So the second thing is in Caleb, I'll just go ahead and jump into your question. What's the typical rule of thumb for these life insurance policies? How much money should I be putting in the first year versus the second year? The way I think about this is actually the ratio. So for example, $100,000, what is 20% of that? 20,000, right? So it's a one fifth comparison between one and the other. I wouldn't do any larger of gap than that. If we start getting too large in a gap, meaning you put in 100,000 and you're only funding with 10, your policy's not going to capitalize very quickly. You're not going to generate a lot of cash value. So I would do 20% or greater when it comes to front loads. So directly to your question, Caleb, you asked, what's the smallest amount of front load I can do? We've done front loads as small as $20,000 and then you start paying $10,000 a year. Technically, that's still a front load, right? Because you put more in the first year than the second year. But at the end of the day, we work with a lot of insurance companies. One American may not be the best fit for that situation. For reasons, perhaps we won't go on to on this video. But talking with an expert team is where you get that advice and you give us your numbers and we'll tell you, based on efficiency, your health and a lot of other metrics, we're going to find out during our process, which carrier may be best suited to the need that you need to get from these policies? No, I appreciate you breaking that down and just also to reiterate, we're showing a termwriter dropped off after year 10. We do that because we're reverse engineering from a cash perspective. But there are a lot of people that it would make sense to include that extra expense because of the insurance protection. And so everyone's in a different situation and I'll just take the sign of plug. We have a link down below if you want to talk to Alden or myself or someone on an amazing team about your situation. Check out that link and it goes to a 15 minute clarity call where we can get information and have conversations with you about your custom goals and plans. So without, we'll get back to the video Alden, I just wanted to plug our clarity call. That's awesome. Thank you, Caleb. So when it comes to picking an insurance carrier, one of the things I love about one America is they put no limiting factors or stipulations against their paid-up additions writer. Okay, what the heck does that mean? Effectively, every carrier we work with to some degree has a rule that says if you don't do x, y, and z, you lose access or they decrease your funding ability with paid-up additions. What America doesn't play that game? Their rule, always from that second year moving forward, is a three times multiple off the base premium. So if your base is 5,000, you can fund up to 20,000, right? And they keep that whether you fund a $1,000 every year extra for the first 10 years starting in year 11, you can still go up to 20,000. Penn Mutual, they have a little bit different. They won't go into the details because you can watch that video link above below or wherever they want to put it. And that video, they're going to dive into some additional information about that specific carrier, right? And what limiting factors are our Lafayette Life is the exact same thing. That's the other big carrier that we use for front loads because of the efficiency, but they kind of mess with the under the paid-up additions writer and how much money you can put into that over time, which can be a limiting factor with that carrier. In other words, one America has one of the most flexible PUA writers ongoing. Exactly. Got it. Yeah. What you said with less words, I like that. Well done. So this is really it. One America front loads, they're great. And the reason I say under $100,000, there's some specific design parameters that if we go over $100,000 in front loaded premium, the multiple on the base to the PUA changes fairly drastically. And that may be a reason to go to another carrier. So front loads under $100,000, one America can be amazing. Accelerated underwriting with cases of this size was also amazing. If we don't have to wait for three months for an offer from an insurance company, if we can do it in three weeks, let's let's do that, right? So that's really all I wanted to show you today on the whole life side of things for front loads with one America. Great company, we love working with them. And if this is something you're interested in, please come talk to me or our team and we'll get it set up for you. All right. So we looked a little bit at where they excel with front loads, right? Whole life insurance front loaded a lot of cash value. We get it, right? What else do they do? One America is an extremely unique company because they not only provide an amazing whole life product, but they also dabble in this little thing called long-term care. Now, if you're not familiar with this, this is effectively a statistical fact. If you're over the age of 65 or anybody who gets to that age, 70% of you are going to need long-term care. Long-term care, depending upon the state that you live in, can be massively expensive. I'm working with a client right now. I won't use his name, but this particular client was working with another advisor before he came to us. This other advisor said, hey, this is a fantastic strategy for you to avoid some of the cost burden of long-term care. This client has a lot of assets. He doesn't need any crazy returns. He just wants some security. Let me show you what they quoted him. Okay. They're diving into this. What we're looking at here is a quote for a deferred income annuity. What that means is right now, this gentleman is 51 years old and we're going to take a lump sum of change. In this case, it's $500,000. Put it into an annuity. Then in 14 years when he's 65 years old, the strategy that was presented to him has, hey, now start taking an income off of this annuity for the rest of your life. As you can see, these are the options that were presented. These are fantastic. You put in 500,000 and you have a potential to get back $2.7, $1.3, or $2.2.5 million of the course of your life, with $90, $78,000, $75,000 of annual income. That's incredible. But remember, where did we start? He came to the advisor looking for a way to mitigate the risk of long-term care. This fixes an income problem. There's a much more efficient way to do this exact same thing with a long-term care specific product. That's where one America really shines. I'm going to share my other screen here. This is called index annuity care. This is a specific annuity product with one America that mitigates the risk of a future long-term care need. The biggest problem with long-term care is we don't know what's going to happen. On average, long-term care claims are between two and a half to three years. We know that in the first example, we're getting $90,000 a year for the rest of your life is amazing, but not if you live three years into retirement. What we're looking at here is a long-term care-specific product. The way that I built this was I actually tied in both the man and the woman, both of the clients that I have, into the same product. This provides protection for both of them instead of the other product that I just protected one. How does this work? This premium is already cheaper. The other product we were looking at was a half million dollars. We're using $386,000 for this particular product. Looking forward, 15 years out, because that's about the time frame that income was being drawn from the other policy. I'm not see if I can highlight this line here for you. Look at this far right hand side. $20,000 a month. If we do some simple math, if the goal is to mitigate long-term care risk, you have $20,000 per month. That's $240,000 of income to mitigate the risk that they came to the table wanting to get fixed. That is four times or three and a half times more effective from a cash flow perspective in the annuity product that they were presented because it wasn't fixing the long-term care need. It was fixing an income need that they don't have. This particular product with one America is extremely efficient, and it gives you a lot of benefit from a long-term care perspective. If you go into a season of life where you need long-term care assistance, whether that's in your home, a skilled nursing facility, or a true nursing home, those expenses can be paid for out of this annuity. That monthly benefit, and where I come up with this number, guys, is that I ran the benefit in the state of California, where these people live with the projections of inflation specific to health care. Right now, the cost on a monthly basis for a nursing home is around $13,000. By age 65, it's around $20,000. So we have to be looking forward at what could be in the future to be able to accurately plan what we should do with our dollars today. This gives them a lot of flexibility, a lot of peace of mind knowing that taking a chunk of money out of their portfolio and directing it to fix a long-term care need, it's an incredible weight off. Now they know, and they have an understanding that they're okay. If something happens, they're going to be fine. They don't need to tap into all of the assets that they have amassed for their family, for their legacy, philanthropy that they want to do. They don't have to touch those. This product will provide all those benefits, and the secret sauce here, guys, a lot of people talk about the living benefits of life insurance. You can add some specific accelerated death benefit writers to life insurance policies. I think that's fantastic. It does not replace long-term care insurance. The biggest benefit to long-term care insurance is that you not only get the product specific to the need, but you get the entire resource team of the issuing company. I don't know if you've walked this. I have a background in the medical medical industry. I've walked this with my grandparents in the past. The needs that come up when you're trying to figure out how to move into a nursing home or get in-home healthcare. Nobody wants to deal with money right then. They just want to pay for it and be done. One America and a lot of other companies that do long-term care, but one America's team is world-class. They provide that resource to help you worry about what you need to worry about, and they take care of the finances and coordinate with all the interested parties that need to be paid. I hope that gives you a good idea of where one America really excels. Just to be clear, this is not an income annuity, so they could they also use this for income if they didn't get long-term care? Or is it one of those? Yeah. This is just for long-term care, and they can't use it if it's not for long-term care. So it's a good question. The purpose of the product is to provide that long-term care benefit once a long-term care need arises. That said, if they want to surrender this, they have a cash surrender value. That's highlighted right there. That's money they can take this whole thing, put in their pocket and walk away. Now, that's taxable, whereas using it as a long-term care benefit, and statistically 70% of people over the age of 65 are going to need something like this, then that is a non-taxable event, and those dollars go directly to the care, and you're not taxable and different. If both of them die and they don't need long-term care, this would this would get passed on to their errors, like the whatever the cash surrender value is. Yeah, if there was never a benefit paid, right? And they never use this product and they passed either prematurely or otherwise, it's still an asset in their balance sheet, right? And that asset would pass through whatever a state tax or a state planning that they've done to their errors, and that surrender value, depending upon the year, is what would pass in value to the next generation. All right, so all then in summary, break this down why this is so much better than the other annuities that they were that they were shown, because the other annuities, like you could use that for long-term care, and so I'm just trying to I want to play Devils Advocate with you before we land the plane here. Amazing. Three reasons. Cost, resources, and taxation. So for that first deferred income annuity, the income that comes out of that product is going to be taxable, right? So that's one problem. With long-term care need, if they use this for long-term care, there's no tax burden. Second, deferred income annuity. You call American General Life Insurance or North American Life Insurance Company or a theme, right? All these other companies doing the deferred income annuities. You call them and say, hey, can you help me coordinate long-term care? They're going to be like, what? Because it's not that product. So there's no resources, there's no coordination of care, which is extremely valuable for people in that situation. And for the third thing, cost is fairly different. Right now, they're 50 years old. The difference between reallocating half a million dollars versus $380,000. The first product was tied to one individual. This product is tied to both. So now we're effectively getting a much greater bang for our buck to mitigate the risk and the need that was described coming into the conversation. At the end of the day, the other product absolutely kale, if you could have used that, you could definitely use a screwdriver and try to bang in a nail on a roofing job. Probably not going to be the most effective thing to do, but yeah, it'll work. So that's why this particular long-term care strategy. And like I said, in Monomerica's amazing at this, their products give us that risk mitigation at a very high degree of efficiency. I think we should do a video sometime breaking down long-term care and just all the products out there that people should be aware of because, rather than about one America, it's not a use it or lose it. I think the traditional long-term care insurance can be scary because you're paying these premiums. You never really want to use it, but it's expensive. It can go up. People can change, that rules can change. And so at the end of the day, this is something that's like, put money aside, you're money's growing more efficiently than it is in a CD or a high yield saves account. Arguably speaking, it could be growing better than some investments, not investment advice, by the way. But it ultimately gives you that huge hedge for long-term care, all tax-free. And again, I'll say it again, it's not a use it or lose it, which I think is really valuable, and it's tied to two humans versus one. So I do appreciate you sharing this. And again, if this is something you want to learn more, I would encourage you to reach out to us. You can use the link down below. Or if you know someone that you know should talk to someone about something like this, we would love to be the company that you guys reach out to. So, all then, as we land the plan of one America, overall, great company, great people, great ratings, very conservative. Like every company, not every company shines in every area, but we showed front loads, especially under 100,000. You said one America is great. They have one of the most flexible PUA riders. Their cash value build up, 93%. You showed first year. Again, everyone's situation might be a little different, depending on what you're fund. But that's just pretty insane. And overall, they also have the ability to do long-term care of products on the life insurance and annuity side by the way. So there's some cool products on the life insurance side that are also neat. And any final thoughts is related to one America. When America, the team itself has been fantastic to work with. A lot of times with insurance carriers, you can act as a number on a piece of paper, and they don't know you personally. I have a high degree of likelihood of calling somebody and I know them on the other end of the phone. And they know me and we have a relationship. It's very hard with some of the big mutuals, just the economy of size, right? But companies like Lafayette Life, One America and Penn Mutual, that's one of the reasons why we love them. We have that personal touch. And One America does very well with that. I love them, man. Love it. Well, as always, really appreciate you. If you guys have questions, comments, thoughts, tomatoes, send them our way in the comments. And please let us know what company you want us to cover next. We have some fun and exciting things in the pipeline as it relates to how we're going to do like a a playlist for every company that we work with and maybe some companies that we don't. And give you kind of like a fair imbalance, pros, cons, you know, things we love about this company, things that we want to be cautious with this company, just so you can have a good pulse on the good, the bad, the ugly in the industry. And so until next time, subscribe so you don't miss out on the series and Alden, thank you again. Absolutely. Thanks, Caleb. Bye, guys. Hey, guys. Just want to interrupt the video real quick. If you like what you see in this video and you want to find out if these numbers and these solutions are going to work for yourself and your family, click the link in the description. It's a clarity call 15 minutes with myself or our team. And we're going to serve you at a very high level, trying to bring some solutions to you to fix your problems.