Introduction: Becoming a Life Insurance Guru Through Policy Design

If you’ve ever wondered why there is so much debate around using life insurance as an asset, you’re not alone. In this video, Caleb Guilliams and Dom set out to “set the record straight” on policy design—explaining when a policy’s structure makes sense and when it might not. They compare four types of whole life insurance designs:

- Fully Based (100% Base)

- 30/70 (30% Base / 70% Paid-Up Additions)

- 17/83 (Approximately 17% Base with an 83% allocation via PUA and term Rider)

- 10/90 (10% Base / 90% Allocation to Term and PUA)

Each design has different implications for cash value accumulation, death benefit levels, break-even points, and overall flexibility. While some critics dismiss life insurance as a poor place to park your money, Caleb and Dom explain that every design has its intended purpose. The key is matching the design to your unique financial objectives—whether that means maximizing a tax-free death benefit for estate planning or generating early liquidity for living intentionally and building wealth while you’re still alive.

Understanding the Building Blocks of Whole Life Policy Design

Before diving into the four designs, it’s important to understand the core components that shape a whole life policy:

- Base Component:

This is the foundation of your policy. It covers the cost of insurance and forms the basis of your death benefit. In a “fully based” policy, 100% of your premium goes toward this base. - Paid-Up Additions (PUA):

PUAs are additional amounts you can pay over your base premium that directly increase the cash value—and, ultimately, the death benefit—of your policy. They are typically more flexible and provide early cash value accumulation. - Term Rider:

Some policy designs include a term rider, which allows you to add extra PUAs in a structured way without making the contract taxable (avoiding a Modified Endowment Contract, or MEC).

The interplay of these elements determines not only how much death benefit you receive but also how quickly your cash value grows. This growth, in turn, is essential if you plan to use your policy as an “And Asset” to borrow against or otherwise leverage in your financial strategy.

Comparing the Four Policy Designs

1. Fully Based (100% Base)

Overview:

- Design: 100% of your premium is allocated to the base component.

- Initial Results: For example, with a $50,000 premium, the first year shows zero cash value and a death benefit of approximately $3.9 million.

- Long-Term Outcome: By year 3, after contributing $150,000 in total, you may see around $25,000 in cash value. The break-even point—where cash value equals total contributions—occurs around year 12, with cash value reaching approximately $624,000 and a slightly higher death benefit of around $4.3 million.

Pros & Cons:

- Pros:

- Maximizes the death benefit, making it attractive for estate planning.

- Offers a high, guaranteed death benefit that is passed on tax-free.

- Cons:

- Minimal early cash value; if your goal is to access funds during your lifetime, this design may be less attractive.

- Critics often say that you’re “putting money away” without immediate benefit.

Key Takeaway:

A fully based policy is ideal if your primary focus is a large, permanent death benefit. However, if you desire early liquidity to support an intentional lifestyle or other investments, you might look elsewhere.

2. The 30/70 Design (30% Base / 70% PUA)

Overview:

- Design: In this structure, 30% of your premium is allocated to the base (cost of insurance), while 70% goes directly toward PUAs, boosting early cash value.

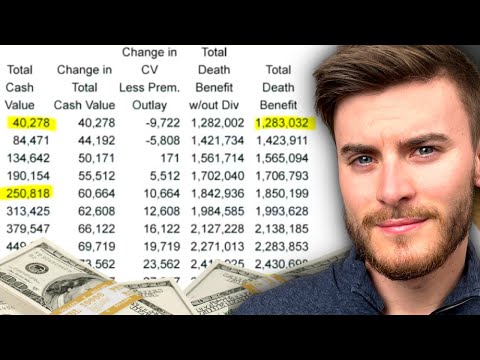

- Initial Results: With a $50,000 premium, the first-year cash value can be around $33,000, though the initial death benefit is lower (around $1.2 million) compared to the fully based policy.

- Performance Over Time:

- Break-Even: Occurs around year 7 (approximately $350,000 total contributions).

- Year 10: An illustration might show a death benefit of roughly $2.4 million and growing cash value.

- Year 20: You might contribute around $1 million to see about $1.6 million in cash value with a death benefit near $4 million.

Pros & Cons:

- Pros:

- Provides substantial early cash value, enhancing liquidity.

- Offers greater flexibility for those who wish to use their cash value actively while still maintaining a growing death benefit.

- Cons:

- The initial death benefit is significantly lower, which might not suit clients whose primary goal is estate planning.

- Requires a trade-off: early liquidity versus a higher death benefit later.

Key Takeaway:

The 30/70 design is a strong option if you value early access to cash. It gives you the ability to live intentionally by using the cash value for investments, debt reduction, or other purposes without waiting over a decade for the policy to “capitalize.”

3. The 17/83 Design (Approximately 17% Base / 83% Allocation with Term Writer)

Overview:

- Design: In this policy, only about 17% of the premium goes to the base, while roughly 83% is directed toward PUAs (often with a term rider included).

- Initial Results: This design is engineered for very aggressive early cash value accumulation. For example, after a $50,000 premium in year one, you might see close to $40,000 in cash value.

- Performance:

- Break-Even: Reached around year 5—significantly earlier than the fully based or 30/70 designs.

- Long-Term: Over time, even though the death benefit starts lower, the enhanced cash value can be used to leverage further growth or be converted via additional strategies.

Pros & Cons:

- Pros:

- Extremely efficient for those who need early cash value.

- Offers flexibility for clients with variable cash flow or immediate liquidity needs.

- Cons:

- The initial death benefit is much lower compared to a fully based policy.

- May require additional strategies (such as pairing with a term rider) if a larger death benefit is desired later.

Key Takeaway:

If you’re looking for the fastest route to significant cash value—perhaps to fund short-term needs or leverage for additional investments—the 17/83 design offers compelling early results. However, be prepared for a lower initial death benefit and a need to balance this with your long-term goals.

4. The 10/90 Design (10% Base / 90% Allocation to Term and PUA)

Overview:

- Design: This aggressive structure allocates only 10% of your premium to the base, with the remaining 90% going to term components and PUAs.

- Initial Results: For a $50,000 premium, this design yields the highest early cash value (e.g., up to $45,000 in year one), although the death benefit might be modest (under $1 million initially).

- Performance Over Time:

- Early Break-Even: May break even around year 4 or 5.

- Year 10 & 20: Illustrations show rapid early growth in cash value, with eventual convergence toward competitive death benefit levels—though differences persist based on company guidelines and individual structuring.

Pros & Cons:

- Pros:

- Provides the most aggressive early cash value, maximizing liquidity.

- Ideal for clients who need immediate access to funds and value short-term flexibility.

- Cons:

- The initial death benefit is lower, which might be a disadvantage for clients focused on long-term estate planning.

- Depending on the insurer, a 10/90 design might be subject to additional restrictions or create challenges with meeting MEC (Modified Endowment Contract) limits.

Key Takeaway:

The 10/90 design is best for clients who prioritize early cash value and liquidity over a high death benefit. It is particularly useful if you plan to actively use your policy’s cash value for other investments or financial needs early in your life.

Choosing the Right Design: Aligning Policy Structure with Your Goals

Caleb and Dom emphasize that there is no one-size-fits-all approach to life insurance policy design. The ideal structure depends on your specific financial objectives:

- If your primary goal is a large, permanent death benefit for estate planning, a fully based (100% base) policy might be best.

- If you need liquidity and early cash value to live intentionally or seize opportunities, designs like the 30/70, 17/83, or 10/90 offer compelling advantages.

- Break-Even Is Not the Whole Story:

While break-even points (when cash value equals total contributions) are important, you must also consider long-term growth, flexibility, and the ability to leverage your policy without sacrificing future borrowing capacity.

Caleb also notes that external factors—such as changing interest rate environments and company-specific dividend rates—can influence long-term projections. It’s important not to rely solely on illustrations, especially over very long time horizons (like 50 years), as these projections may differ significantly from actual performance.

Conclusion: Become a More Intentional Life Insurance User

By comparing these four policy designs, Caleb Guilliams and Dom show that understanding the nuances of whole life insurance can transform the way you view it. Rather than dismissing life insurance as a poor place to “put your money,” you can choose a design that aligns with your financial goals—whether that means maximizing a tax-free death benefit for your heirs or generating early liquidity to build wealth while you’re alive.

Key takeaways include:

- Different designs offer trade-offs: Fully based policies offer high death benefits but little early cash value, while designs like 30/70, 17/83, and 10/90 prioritize early liquidity at the expense of initial death benefit.

- Your goals matter: Determine whether you need immediate cash value to live intentionally and invest further, or if your primary focus is long-term estate planning.

- Flexibility is crucial: The right design can provide a window of flexible premium contributions, enabling you to adjust based on your cash flow and life circumstances.

- Focus on the big picture: Break-even analysis is just one metric—true efficiency lies in how well your policy supports your overall financial strategy.

If you’re considering a whole life policy or already have one in place, use these insights to ask the right questions. Work closely with knowledgeable advisors who understand the intricacies of these designs. In doing so, you’ll be better positioned to make your dollars work multiple jobs—growing tax-advantaged while providing both immediate liquidity and a lasting legacy.

Whether you’re an advisor, an agent, or an informed policyholder, this discussion is designed to help you become a true life insurance guru.

By understanding the trade-offs between various policy designs, you can tailor your life insurance to not only protect your loved ones but also to serve as a powerful, flexible asset that enhances your financial efficiency over the long term.

Full Transcript

Hey everybody, welcome to the BetterWealth Channel. I'm here with Dom. It's been a while. This has been a highly request video. We're going to be looking at four policies. The first policy is going to be a fully based. There's a lot of people out there that say life insurance is a terrible place to put your money. And we will show you why they're 100% right. Then we're going to show you a 3070. We're going to explain what that means in a second. Then we're going to show you a 1783. We'll explain that in a second. And then we're going to do a 1090, which a lot of people on the internet are like 1090s are the best. And we're going to look at the pros and cons of every design. And you will be a life insurance guru at the end of this video. And whether you're an advisor and agent or whether you're in the space seeing is this policy right for me. Hopefully this video is very educational. And this video would not be possible without the end asset. And my partner here, Dom. So thank you for being here, man. Yeah. And I can't wait to be a guru after this video myself. Because I learned something every day. And so this is going to be another one of those days. I'll also say that we did a video like this a couple of years ago in what we call now the dungeon. There was literally like a closet that we put some lights in. And so hopefully you can appreciate the backdrop. And with that, we're going to jump right in to the numbers. So when we talk about 100% base, a life insurance policy is built using really three type of components if I'm going to simplify it. Component number one is the base. This is what is like the foundational aspect when you look at life insurance. And when you look at PUA, that's when you get early cash value. And also in most cases, PUA is totally flexible. And so you get flexibility, early cash value, and better long-term growth. And then you could add a termwriter, which just allows you to fit in a more PUA to not mac and make the contract taxable. In this scenario, we're just looking at 100% base. We're not looking at PUA or term. And as you can see, we're showing $50,000 going in. $50,000 going in and a cash value of $0 with a $3.9 million death benefit. So first year, we've put $50,000 in. And we have $3.9 million of death benefit to show for it. But we have absolutely zero cash value to show for it. On year three, you've put a total of $150,000. And now you finally have $25,000 of cash value to show for it. You can see the death benefit pretty much stays level. You can see that it continues to grow. This break even is year 12, meaning that we have more cash value. You can see here, you have more cash value, $624,000 of cash value, and you've put in $600,000. And so it takes 12 years to do what we call capitalize. Your death benefit is a little bit higher. It's 4.3 million dollars. And you can see, Dom, why a lot of people are like life insurance is a horrible place to put your money. You've put in $100,000. You have nothing to show for it. You have a death benefit that matters to some families more than others. But overall, you can see why this is not very attractive. And very few people online would be like, yeah, I love that. That sounds amazing. Yeah, I'm starting to become a little bit more mature in my walk. I would say with life insurance. I say that from a face standpoint, because I'm very strong relationship with Christ. But when it comes to my walk in the insurance industry, I've kind of flip-flopped back and forth in regards to how I want to talk in position about life insurance and the cash versus the death benefit. And I would have demonized something like this, very, very, very heavily early on in my career. And now I'm from the camp and understand that this is a necessarily good or bad. This is just has a specific purpose. And this specific purpose potentially is focused on the death benefit for someone like an estate plan, or that wants a permanent death benefit for as much death benefit as possible. But if you were on this channel and you were subscribed to the Better Well channel, odds are you are not wanting to look at the death benefit as your number one priority in goal. Now, you understand that it's important and it's a value at your life, passed down from a legacy perspective. But you are somebody that wants to live an intentional life today and while you're alive, and to use the cash value for other purposes to build wealth. Yeah, I think that was well put. And also, while you're watching this, make sure to take notes because we're going to be comparing year 20. Because I think there's wisdom in looking long term, but not super long term. So like, never look at an illustration over 50 years, because at the end of the day, I can guarantee you, which is a 30 word in our space, but I can guarantee you that the illustration is not going to be anywhere close to the projection. It could, your cash and death benefit could be higher than what your illustration looks like, or it could be lower. But it's one of those things where we should, there's wisdom in looking out, but there's also wisdom in not looking out too far because a lot of times someone can suck you in by saying, oh, look at 40, 50 years, and there can be a lot that happens in the next 40, 50 years. And I would never do something for a 50 year outcome. And if that outcome didn't happen the way I think it was going to happen, it would ruin everything. And that's just something that we need to be careful when we're looking long term to understand that time as a factor. Yeah, I would say the main reasons why is the economic environment changes from year to year, right? If you even just look a year ago, the interest rate environment was an extreme low. We're going to talk about how the interest rate environment has impacted the overall life insurance industry and insurance industry in general. And typically when the insurance industry is suffering from a lower interest rate environment, they can't produce as great results in their investment portfolios. So their dividends have to be smaller. And therefore, when an interest rate environment is higher, they can produce greater results, which can produce higher dividend. And so if interest rates stay up high and go keep going higher, that these actual performances will be better that future. And that's why if you actually look at a lot of the illustrations from way back in the day, they were showing a projected number. And they're actually higher than they were actually projected, which is great. I think that could be a pro boned managed. And also, insurance companies are going to change their investment portfolio and what they're investing in. Some will invest in more riskier things or more invest in bonds. And things will change based off of where they think that their dollars are best used. And that can change today as it could change 50 years from now, just like for you, what your investing today is going to change 50 years from now as well. I think it's also fair to say that anything can change, but we're showing illustrations that are pretty low interest rate environment. And so overall, these projections are conservative. It may be worse, but there's a good chance that they'll be close or better performance in the long run based on the time that we're running these illustrations. So what we also like about this in general, though, is there's a really good likelihood that they'll at least be kind of close because there's a guaranteed piece into it that in whole life insurance that you don't get with other insurance products. And hence, why we show a lot of examples with whole life because one of the killer elements that we talk about is life insurance shouldn't be your investment. And so if we're gonna show numbers, let's show something that's going to be somewhat more accurate than a potential projection using arbitrage. And so that's a whole nother video. But you can see it over your 20 because we're gonna look at the four policies and look at year 20. We look at year 20, you've put in a million dollars and you have $1.4 million of cash value with a total death benefit of $4.9 million. So as you're watching this, make sure to like take note, $1 million contributed, $1.4 million of cash value, and $4.9 million of death benefit. To summarize this, this fully based policy is not something that we would sell a lot of. It's not what a lot of people would be raising their hands. But you can look out even after 20 years, you could make the argument that life insurance would be a benefit for your portfolio. You have a permanent death benefit. Almost $5 million that would get passed on income tax free. And a non-volatile, non-correlated, safe asset that has special tax advantages. You can see where even if someone sold this, they would say, okay, over long term, this is a good policy. Anything else you wanna say before we jump on? Yeah, I think what you said at the very end is like, it may not be the sexiest thing or the desired result, but it is a result that still can produce fantastic results. Okay, now we're gonna look at a 3070. And now it's my understanding, Dom, that we're not using the term rider here, but we are using PUA and base. Correct. And so when I say 30, it's where we're saying that 30% is the base and 70% is what's going to the PUA. And you'll see, in this example, you'll see a couple differences. And so instead of first year having a total goose egg, you have $33,000 of cash value versus zero. And you have a total death benefit instead of 3.9 million, you have a death benefit of 1.2. So the big differences, the tradeoff of permanent death benefit versus early cash value and that really comes down to when you're buying, when you're using paid up additions, you're going to see that the death benefit is going to increase more significantly long term, but early on the initial death benefit is a lot smaller. Yeah, and of your $50,000 premium, just think of it, it's gotta go somewhere. And that's just saying a percentage of it, 30% is going to the base, which is cost of insurance essentially, and the other 70% is going directly to cash. And that's why you can see that the 33,431 is close to about 70,000. Now there's a PUA charge upfront as well that actually gets smaller as time goes on after year one. But you can see if you did the math 33,431 divided by 50,000, it gets you probably right under 70%. Right. And this has a break even of year seven, which again, break even means we've put in $350,000 and we actually have more cash value to show for it. We're gonna see at the end of this video that break even is not the only fact that you should care about. And we're gonna show you at the end, a policy that breaks even earlier, and a lot of you would choose a different policy. It's kind of like the hook to stay around, because a lot of times people come to us and they'll be like, this is all I care about, break even because that's what they see on the internet. And again, break even matters. If you cancel this policy, you actually have more money than what you put in. That's awesome. But break even doesn't necessarily tell the whole story. So in year 10, we've put in half a million, we have 580 of cash value with the death benefit of 2.4. You can see that it's grown. And then when you look at year 20, you have put that million in, and you have 1.6 million of cash value and a death benefit of 4 million. So if you compare that to the base, we've had 1.4 million of cash value in the fully based contract with a death benefit of still 4.9. So in the fully based contract, you have a higher death benefit still, which is a value that's an asset. But overall, the cash value is more than 200,000. You have way more flexibility, meaning you don't have to in the fully based contract, you have to pay the base contribution until your policies capitalize to give you options. Here, the base is 30% of 50, which creates more flexibility. And you can see that you have early cash value where after year one or two, you could very much pay the base in different type of ways. Yeah, and a really smart play is even though the base is 37% of the other 100% base, and the death benefit here is a third less than the other one, a really savvy strategy that we can do is we can put a 30-year term insurance on yourself to cover yourself for the separate death benefit and capitalize on our cash value whole lot sooner. And then when that 30-year term essentially is non-existent, your death benefits will be pretty close to the 100% base policy in this type of policy. That's a really good ninja trick. All right, now we're gonna get into 17, 83, and if you are OCD, this really bothers you. Why can we do a 80-dog? Why can't we do that? It's companies, some kinds of companies be like that. The reason is for this company, for this company, the most efficient design that we could do for this age is 17, 83. So 17% is going to base, 83% is going to PUA and some type of term writer. Yeah, with this policy, the 17% is actually going to the base and the term writer, which is why the, the, it's so funky, is essentially the term writer's in there, and then the term writer can put it makes the, and the previous one, there was no term writer, so we're able to get a cleaner number. Right, and so what this is really representing is the actual contribution that you have to make early on. Okay. So it's one of those I appreciate you mentioning that. It's a combination of base and term, but what we're saying is those have to be paid early on to make sure that the policy isn't good order, and you'll find that after year one, you could easily do that, even if you couldn't do out-of-pocket, because you have enough cash value in the policy. So we're looking at $50,000 going in. You have a cash value of 40,000 in the first year, which is awesome, and with a total depth benefit of 1.2 million, and you can see that this looks slightly different, and it's because of the term writer. You can see that this breaks even in year five, making this break even two years earlier than the 3070. The year 10 depth benefit is 2.5 million with a cash value of 600,000, which overall, the cash value in both, the 600,000 is $20,000 more than the year 10 example for the 3070, and if you look out over year 20, you've put in a million dollars, you have 1.6 million dollars of cash value with a depth benefit of 4.1. And so overall, this is more attractive from a flexibility standpoint. It's more attractive from an end cash value standpoint, but it doesn't, it's not as extreme from the 3070 to 1783, but there's a little bit of flexibility and for people that are looking at this, you can see a theme. It's like, hey, if depth benefit is not up there from a standpoint of like, hey, a permanent debt that is really important, you want flexibility, you want long-term growth, usually in many cases, if we're sticking with the same company that you like, lowering the base creates more flexibility in long-term growth. Yeah, and Caleb says the word flexibility, I want to just kind of reiterate in the basic formality of it, you have a total amount of premium that you have the ability to contribute, which is $50,000. Based off of the IRS, the IRS will say, okay, this much depth benefit, you can put in this much money at your ceiling, and then based off of the insurance company, they'll say you have a minimum amount that you're required to contribute. And in that very, very, very minimal base policy, it was about $8,000 was the minimum that you had to contribute your after-year, and in the maximum was 50. So we essentially have a window, a flexible window of contributing $8,000 all the way up to 50, which is great for entrepreneurs and business owners and people that cash flow varies because you may have a great year one year and not a great year another year, and it gives you that ability to contribute in that window. Yeah, and I think that's really, really important because life happens, and we want to make sure that we can maximize our ability to save, to compound and control our money, but we're not creating something that's actually going to be a pain in our side in the future. Yeah, and then in the 100% base policy, there is no flexibility at all. There's no window at all. It's just, you just have a floor and a ceiling that are the same same, which essentially was $50,000. Yeah, all right. Now we're gonna look at a $10,90, meaning we're looking at 10% base and term. In this scenario, it is a 10% base with a 90% that's going to the term and the PUA. This is why he's the expert, and I'm the co-pilot. And so in this example, you're gonna see, you're gonna have earlier cash value, but you're gonna also see that it looks a little bit different than the examples earlier on, and it's because the company that we showed originally can't do a 10,90. Like, it's my understanding that it would create a Mac for their guidelines, and as a result, making the life insurance taxable. And so we actually am switching different companies, and you'll see the pros and cons, but I think the caveat is, normally, if you are with one company, the lower the base, the better, but if you compare company to company, there may be other companies that outperform, as you'll see, even if they're not a 10,90. That's a good way to explain it. So now we're jumping in, we're going to say, okay, this is a 10,90, so you're gonna put $50,000 of premium in the first year, and boom, you got $45,000 of cash value, which if you remember, is way ahead of the other examples, and your death benefit doesn't even go above a million, which, and again, a lot of people, this makes sense. Earlier, cash value early on, death benefit is $847,000, we're all good. This break even is in year, whoa, it's almost in year four, can someone donate $130 to this, it would be in year four, but this technically, this break even is year, year five, with $256,000, and so if you compare it to this policy up here, this also breaks even, but 10,90, it actually has a little bit more cash value early on, okay? So it has a little bit more cash value early on. You can look at year 10, you've put in, you know, $500,000 of premium, you've put, you have a total of 5.81, with a total death benefit of 1.88 million, so this is a great policy. Like, just wanna point that out, year 20, you have, you've put in a million dollars of premium, and you have 1.4 million dollars of cash value, and $3.2 million of death benefit. So I just wanna point out a couple things. You know, people will come to us, and all they care about is, hey, I want break events as soon as possible, or I want the earliest cash value early on, and you can see where the 10,90, even at a different company, it does that. I mean, you have earlier cash value, you break even the same year as the 17,83, you have $6,000, essentially more cash, and it performs well, but I want you to remember, at year 10, you have $581,000 of cash value, and in year 20, you have 1.4 million dollars of cash value, you, at year 10, your death benefit is 1.8, and in year 20, your death benefit is 3.2, and so we're just gonna look at this other company that doesn't give you as early cash value, but if you look at year 10, you have $600,000 of cash value, which is, that's a difference, it's a $20,000 difference with a pretty different death benefit outlook, a $2.5 million death benefit, and year 20, you have $1.6 million of cash value with a permanent death benefit of 4.1, so the end result is, we're not saying that one design is better, I would never say that a 17,83 is the best policy design for you, because we're gonna have another video, that we're gonna show you what's called a front load, and if you are sitting on a bunch of cash, there might be some amazing examples for you to actually not even do a policy design like this, but front load of policy, and there's a lot of benefits in pros and cons. I think the key is, whenever we work with people, we try to get really crystal clear, and like, what are you trying to accomplish, and know that life insurance is not the end solution, it's not the end investment, it's the place that you can store and use your capital, and hopefully as a tool, be able to help you get closer to the results, get closer to where you wanna go, and in some cases, people are like early, that $5,000 of earlier cash value is actually better for me, because I would rather have earlier cash value lower growth long term, and because I can flip that money and that end result will be better. And then there's some people that are like, no way, like I would much rather have the death benefit increase and the cash value increase, and I don't necessarily care about the first couple of years that difference, and that's really, it comes down to your situation, and we're just showing two examples of two companies, but there's multiple different companies that we could add into the mix, and the same conversation goes, get really clear in what you want, and then is the policy best designed to help you accomplish your goals? Yeah, and you may be asking, well, why is that the case? Like, why are companies operate so differently? Like, why is one cash value so different together and the base peritials are different? Like, why is that? Well, there's a ton of factors that come into place. These policies can have a guarantee value of two to 3.75% and that's a gross number, and so each company will price it differently. There's a different dividend rate, which currently they're around between five to 6%, and then those also have a expense and mortality cost to it as well. So every company is gonna operate differently, have different expenses, and on top of that, they're gonna invest in things that are also different, and when you look at some companies, they invest in more riskier assets or putting their money into higher potential returns, they can project higher values as well, and then on the other side, people are more conservative, and so people are more guaranteed focused or companies are more dividend focused. Some companies have stronger financials. There's just so many different factors that come involved in why companies operate the way they operate, and another thing is some companies are advocating for infinite banking. So therefore, they're gonna potentially push more cash value up front since that's kind of the way the infinite bankers look, and then some companies may be more on the retirement side and they may want to not have people take cash value loans against their policy. So therefore, they're going to advocate for having longer term cash value versus having short term cash value. So there's just so many differences per company, per company. That's why Caleb is saying it's important to figure out your goals, and then kind of back it into it that way. So we would love to hear from you if you have questions, thoughts, different examples that you want, Dominite to explore. Please make the comment, tell us in the comments below. We appreciate everyone that subscribes and shares our content, and watch out for the next video on Frontload.