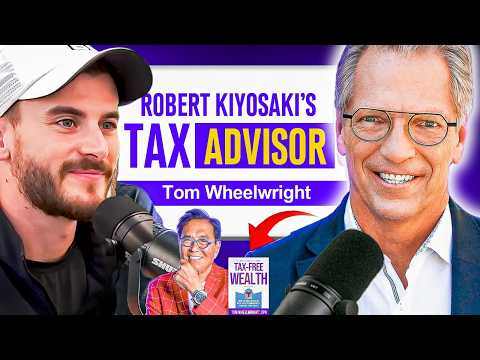

Robert Kiyosakis CPA Reveals Top Tax Incentives For Wealth Building

In a recent discussion, Tom Wheelwright, CPA for Robert Kiyosaki and author of "Tax-Free Wealth," shed light on the complexities surrounding current tax proposals and their potential impacts. Here's a breakdown of what you need to know.

The Power of Taxation

According to Robert Kiyosaki, "the government's greatest power is the power to tax." The value of the dollar is intrinsically tied to our requirement to pay taxes with it, making any shifts in tax policy critically impactful.

The Role of Business in Taxation

Starting a business is one of the most tax-incentivized investments, which explains why major corporations sometimes appear to pay little in taxes. The government provides these incentives to foster economic growth, but changing tax rates could shift this dynamic.

Concerns about Capital Gains Tax

Recent tax proposals suggest increasing the capital gains tax rate from 20% to potentially 50% when combined with state taxes. This could heavily impact:

- Home sales

- Stock options

- Jewelry and other valuable assets

- Business sales

Unrealized Capital Gains Tax

One of the more contentious proposals is the idea of taxing unrealized capital gains, which could affect anyone whose assets have increased in value, from homes to heirlooms, requiring annual appraisals.

Policy Implications

These tax changes could lead to a number of consequences, including:

- Reduced asset sales as individuals delay liquidating their investments.

- A slowdown in real estate market transactions due to decrease in liquidity.

- Potentially unconstitutional implications requiring legal scrutiny.

A Global Comparison

Tax regimes with similar policies, such as what was seen in France, often lead to economic migration or evasion, as those affected seek to preserve their wealth.

Conclusion

Though politically charged, these discussions highlight the necessity for informed public debate around taxation and fiscal policy. As Tom points out, while these proposals aim at the wealthy, their broader economic implications can ripple across all economic strata.

Full Transcript

Tom will write CPA for Robert Kiyosaki, author of Tax Free Well. And I'll never forget Robert looked at me and he goes, really? I said, yeah, he goes, whoa, the government's greatest power is the power to tax. The reason the dollar has value is because you pay your taxes in it. Interesting. If you were not required to pay your taxes in dollars, it would lose all this value. Now, let's get to the worst of it. From your perspective, what is your thoughts on using life insurance as an asset? It's fascinating when you write a book and you discover things so you didn't know. And what I discovered was business is the number one tax incentivized investment in every country. So the government literally will pay you to start a business. If you wonder, why did Elon Musk not pay tax for 20 years or why did Amazon not pay tax for 20 years, it's because of this. Tom will write CPA for Robert Kiyosaki, author of Tax Free Well. And author of another book that I'm going to promote heavily in this interview. Welcome to the show. Hey, thanks so much, Caleb. So good to be with you. You know, this is one of those comfortable circle moments. I remember seeing you speak when I was 19 years old. And I was so inspired. And I love how you showed up. You actually made this whole idea of taxes, like somewhat fun and exciting for me to want to pursue. And obviously, anytime I'd ask people like, what's been the number one book that has impacted your life? It's either the Bible, think and grow rich or rich or rich dad poor dad. And I interviewed another person yesterday and their whole journey started with rich dad poor dad. So you have Robert Kiyosaki, who's probably the most iconic well-known person in the space, wrote one of the most successful books that have changed so many people. And he's not only wrote in a forward for one of your books. You are his CPA. You've traveled the world with him on stage. And so it's just an honor to have you. Beyond the show, it's been an honor to get to know you. You've been so kind to even come out to my latest event and get to speak. I remember when we connected, it was like six months ago. I remember speaking after you and it was probably one of the most nerve-wracking talks I've ever given. I was like, I hope you just leave the room. But the fact that you were in the back of the room, I was like, I had to make sure I didn't mess up too bad. And so overall, Tom, thank you for being on. And I'm grateful that you're on the show. I'm happy to be here and you did great. So we could go a lot of different places. I think what I would like to start with is we're recording this August 22nd. And there's a lot of crazy things happening with the election. You have Donald Trump on one end. You have Kamala Harris who should be accepting her nomination for the Democratic Party tonight. And she's opened up her mouth on a couple things. And I would just would love to hear your thoughts, current events. And then what I would like to do is go back and talk about some of your frameworks as a release attacks. You wrote an amazing book that is not as known as it should be. And I would love every single one of the people listening and watching this to go get your your book. And I would love to dive into your newest book. And you even have a section on life insurance. A lot of the people that follow this podcast and YouTube, like love when we talk about life insurance. I'll definitely ask you that as well. So welcome to the show. Thank you. So yes, Kamala should probably stop opening her mouth when it comes to economics, because first of all, what got Venezuela to where it is is price controls. Price controls are basically what dictators and communists do. It is a very bad, bad, policy. So and to blame it on, especially grocery stores, I'm going, nobody took it in the shorts, takes it in the shorts on inflation like grocery stores do, because they can never stay ahead, right? Their prices go up faster than they can raise prices. And so I think that's bad. But this thing on unrealized capital gains. So here's, can we just talk about this for a minute? Absolutely. Because Joe Biden, now we have to assume for whatever, Kamala Harris is actually making it worse than Joe Biden did. But we have to assume that what she hasn't said, she'll pretty much follow what Joe Biden, you know, what the Democrats put in in the budget for 2020, 2023, 24. So this year's budget. And I want to just kind of walk through just just stay with me and walk through exactly what happens on capital gains. Okay, so first thing they want to do is they want to raise the capital gains rate from a maximum of 20% to a maximum of 45%. And the first question people go, well, wait a minute, I thought they want to just raise the rate to 39.6. Yes, but they also want to impose the Medicare tax and raise it to 5% and they want to impose it on capital gains. So that means that you're at 45%. You add another 5% for your state, which you probably have. You're at a 50% tax rate on capital gains. All right, so think about this. Your home goes up in value. You sell it and give 50% to the government. Your stock options from work go up in value. You sell them. You get 50% to the government. Your jewelry goes up in value. You feel I have to sell it now. You've got 50% capital gains. But here's the worst one. You're a business owner. And you've put your entire life, life savings into your business. You've decided you know that that's your retirement. And you didn't do it for one, okay, because you put your money into your business so that you could serve more people. Okay, so the promise was when you retire, you'll sell your business and you'll pay capital gains taxes 20%. So instead, what's going to happen is you're going to sell your business and you're going to pay 50%, not 20%. Now, let's compare that to the average employee. The average employee puts their money in the 401k. They're taking out, let's say that they're both going to live on $200,000 a year. The thing is, the employee is going to get taxed at roughly 20% because that's the average rate at $200,000. But the business owner is going to get taxed at 50% because it's all in one year. And you can't prevent that. You can't sell a business on an installment sale. You're going to sell the business. The buyer wants to pay you now. They don't want to wait to pay you. Okay, now that's the capital gains. Now, just to ask a question for you, does this, is this one of these like you have to be worth $100 million? No, this is so, so right now, okay, we'll jump to that. But right now, it's a million dollars. So for a business owner, for a business owner, you're absolutely going to sell your business for more than $1 million. I mean, you know, your average employee, if you've got $200,000 a year of 401k money, you put more than a minute, you've got more than a million dollars in your 401k. But now what's going on is, is you're going to have capital gains. Let's say you sell your business for $5 million, $4 million of which you're going to pay 50%. So it's just a million dollars, okay? But keep that in mind because remember that when the income tax came into effect in 1913, it was only a 7% rate and only on the very, the point 001% of the population, okay? And now it affects over 50% of Americans. All right, so just keep that in mind. So you're saying you're saying just because whatever they say today, they're just, it's one of those things. But here's what happens. Yeah, it's way easier to lower through threshold. Correct. Then it is to raise the rates in the first place. Correct. Okay. So it just becomes easy for, because politicians have never seen a dollar of your money that they didn't want. Yeah, that's right. Never, right? Yeah. It's like, they look at, they look at taxpayers, I swear, at the convention this week, they're looking at everybody in the NSA, is that my money in your pocket? And that is, that is certainly the way the, the Democratic parties is certainly looking at it. Absolutely. So Tom, just to just to reiterate what you're saying, it would be easier to say, hey, we're going to, we're going to pay like, let's say this 45% tax is going to trigger on a million, million bucks. Right. And then what could happen in the future, not that you're saying this, but they could lower that to 250. Right. They could say we didn't change the rate at all. Exactly. But you just, you brought in more revenue. You made more people. Yeah. Well, here, from a policy standpoint, here's the worst part. They won't raise revenue. It doesn't raise any revenue. When you raise the capital gains rate, you actually lose revenue. Yeah. Because people stop selling. So, so let's, let's take that example. Let's say you go, well, instead of selling my business, I'm just going to give it to my kids. Yeah. Guess what? Under Joe Biden's plan, a gift would cause capital gains tax. Okay. So now you're paying 50% even though you have no money. Now, instead you go, well, okay, well, then I'll just wait until I die. Oh, but under under the under the Democrats plan, you'll pay 50% capital gains tax when you die plus 40% of state tax. So you'll pay 90% so your kids get 10% of it. Okay. So you go, all right. Well, here's what it is. I've got this office building and I'll just sell it for my retirement and I'll just get a different kind of building like a Walgreens or, you know, something that just pays me a monthly check, right? I'll do that. Well, right now, that's tax-free, right? That's called the light kind exchange or 1031 exchange. Not under the Democrats plan. Under the Democrats plan, that's taxable subject to 50% capital gains tax. Okay. Now, let's get to the worst of it. The worst of it is, okay, you know what? It's too hard. I'm just going to hold on to it. Now, we have an unrealized capital gains tax. Also 50%. Okay. So now we're going to have an unrealized capital gains tax. All right. Let's think how bad this unrealized capital gains tax is. First of all, it's probably unconstitutional, but we don't know that for sure because there are actually provisions in the law that allow for unrealized gain to be taxed. There are a couple of provisions in there. So it's not as clear as some people think it is. But let's say, okay, your business goes up in value. Now, you have to get an appraisal, which runs about 30,000 dollars for an appraisal. I have to get an appraisal every year. I have to pay for that. The IRS doesn't pay for that. I pay for that. And you're going to tax me on the increase in value even though I got no more money. And I already paid tax on the income. And the only reason I increase in values because I made money, but you tax me on the income. So now you tax me also on the increase in value. Okay. So you go, well, wait a minute. What else? Well, your jewelry goes up in value. You're not selling it. These are heirlooms. You've had this is your grandmother's wedding ring. And this is an heirloom. It goes up in value. Capital gains tax. Okay. Or your home, your home goes up in value. Your home goes up in value. Guess what? Capital gains tax. Now, that, you know, the, the, the, the, the, the, the naysayers would say, well, wait a minute. That's the billionaires tax. Okay. Well, that's first of all, specify that it's not a billionaires tax. Is a tax on 100 main. And for those clearly, the Biden-Harris administration cannot do math because you called it a billionaires tax and it's on people making a, a tenth of a billion dollars. One just clear. It's not making is a total net worth. And it's not worth, right? But still, it's, it's not a billion. Okay. A billion is one more zero. Right. Then a hundred million. So a hundred million is one tenth of a billion. Now, how long will it take before that hundred million becomes ten million becomes one million? And you go, well, one million, that's still a lot. I'm going, wait a minute. Your IRA could be more than a million. When your IRA goes up in value, are you going to get an unrealized capital gains tax on your increase in your IRA value? Potentially you are. So this is really, really bad policy. It's very hard to administer. Are you going to get an appraisal on your, on your jewelry every year? Are you going to get a appraisal on your home every year? Who's going to do these appraisals? I mean, it's completely unworked. You know, France, Europe has done this before. They tried this. France did it. Everybody, the rich people just moved. Yeah. Now you can't do that in the US. You can't just move. We're, we're taxed on worldwide. So you can't just move and get out of there. You got ten years before you have, even if you give up your citizenship, the US contacts you for ten years. So it's not that easy. Okay. However, that the administration of it is horrible. It would literally just, just one of these proposals would have a really big negative impact on the economy. Think about just getting rid of the like kind of change. You'd eliminate the liquidity in the real state market, basically. You just made it. Especially if you combine that with a 50% capital gains rate. Now you said, okay, nobody's going to sell. You think it's, you think it's tough to buy a house now? Wait until you get a 50% capital gains tax. Nobody's going to sell. Nobody's in the other house. You're not going to be able to afford to sell your house. Yeah. That's, it's very, very concerning. And you wonder why do you think this was even floated? You would think if you were a political strategist, you'd just be like, Hey, why don't you not say anything? Like, why don't you just take a moderate position? Because everyone's going to vote for you regardless. Like, like, I'm just wondering, like, I'm glad these things are being said. Because at least it's true. I'm glad finally, finally people are starting to talk about tax. And there's about a $10 trillion difference between the two parties. It's $10 trillion. I mean, that's not a billion. By the way, that is a lot. That is a thousand billion. Yeah. Just just 10 trillion is a thousand billion. Yeah. Actually, it's 10 trillion is 10,000 billion, right? It's crazy. It's 10,000. I mean, it's like, how can you even think this, these kinds of dollars, right? But here's what happens. There, there's this. And really, I will say that, AOC started it. She really did. She was the one, you know, she wore the dress, taxed the rich. There's this whole thing. And, and honestly, I think the very wealthy are somewhat to blame for this. Okay. Because they have not it's not that the average person is making less money. The average person is not. The average person is doing better now than they did 20 years ago. But the rich person is doing even better than that. And so, and that's just compound interest. I mean, you know, you talk about that all the time, Caleb. I mean, compound interest, the more wealth you have, the bigger the compounding, right? So, so of course, they're going to have more money. And of course, all the policies during COVID was really the effect was it all got more money to the wealthy. And so, and so, what happens is is that people have this idea, well, it's okay to tax the rich. Because I'm not one of the rich. Everybody is good with taxing somebody else's money. When it starts affecting them, they get upset. But here's the reason they've been able to get away with this dialogue. Well, it only affects people making more than $400,000. Well, by the way, that is fundamentally false. Let's take the the idea of increasing the corporate tax rate to 28%. Well, you think that's not going to affect the value of the stocks in your 401k portfolio? Of course it is. You think it's not going to affect the amount of raises that they give to to to the employees. Of course, it does. And there's really good data on this. I mean, this isn't supposition. It's been done before. We know what happens. So, I think there's just it's it's a really interesting. It's actually why I wrote when we'll strategy. I wrote this book specifically because of this. Because I don't like the dialogue. I'm what I have a problem with Hillary Clinton's proposal of a four or five percent surtax over 10 million dollars. Honestly, I would have no problem with that. I don't I don't even have an issue raising the rate from 37% 39.6%. I mean, it probably should stay under 40% for you know, the middle class up or middle class person because they take that extra money and invest it all. And they don't typically invest just in the stock market. They're typically investing in a business. They're typically investing in real estate. They're typically investing in real assets, hard assets. The very rich, they have to put their money in the stock market because they're or the bond market because there's nowhere else they can put it. Yeah. Right. That they it's easy to invest a million dollars. It's really hard to invest a hundred million dollars. So the only place is in the markets. And so I'm not against I'm not against tax and I'm not against you know adding like a surtax for a certain level of income. I don't have an issue with that. I really don't. I think they're I think the taxes on the very wealthy are maybe a little understated right now. However, what we have to recognize is is that the effect if you tax the investors, then what happens is that money doesn't go into investment. Yeah. Here's what happens to it. So so interestingly enough. So in Biden's budget this year, the tax increase would have been $5 trillion. Had he got what he wanted. The spending increase is for and a half trillion dollars. So the issue to me. Yeah. It's bad enough the tax increase the five-trade. But the bigger issues the foreign afterying. Where's that money going to go? Well, okay. People go well, that means that it's going to be done in transfer payments, child tax credit, et cetera, et cetera. Okay. And where are you going to spend that money? I'm going to spend it on Amazon. Who owns Amazon? Jeff Bezos. So it keeps it always ends up back. Yeah. In the pockets of the wealthy. Right. You can't stop that. It's always getting into back in the pockets of the wealthy. So you go, okay, but at least in the meantime, I get spend it. Okay. But you're going to cause inflation. I mean, four and a half trillion dollars. Yeah. You know, to blame going back to price, gouging and price controls to blame the retailers for inflation. Are you kidding me? That's like blaming the victim for the crime. Yeah. And also, companies are not just going to lose money. So it's like, yeah, you can say all you want. You can say they're evil by raising their prices. Why don't you tell them they can't raise their prices. See what happens? Like there's actually, this has happened in history. And I don't think point to one example where this was like, yeah, this was a great move. You know, our economy is way better because of this. Well, this is it's exactly what's going on. Venice weather right now. Right. They put price controls on. And then what happens is then, okay, so I so you have shortages. And if I have shortages, I'm going to get in the black market. Yeah. That's what I'm going to do. Before we jump in your book, the tax and jobs act is going to be sunsetting in 2000. 2025 and 2026. Okay. That's a big deal. And it's my understanding that it's my understanding that if a Republican, if Donald Trump gets in the office, he's going to continue, continue that. And then if a Democrat gets in office, they're probably going to just let it expire. Well, again, it's not just the president, the matters, right? Congress matters. So I actually think that congressional elections are at least as important as the presidential election. Let me put it just a slightly different way if I could kill them. If the Democrats sweep, in other words, they get they get a majority of the House, the Senate, and the presidency. Then yes, you can expect I would expect anywhere from a five to 10 trillion dollar tax increase. That's what's going to happen. If the Republicans sweep, what'll happen is, is that you'll get probably something of an extension of the 2017 tax law. And there are some really good provisions. By the way, the corporate tax rate is not does not sunset. That's the only thing that doesn't sunset. So even if the Democrats sweep, they would actually have to convince all of the other Democrats to vote for increase in corporate income tax, even though it's really, even though it seems like a good idea because all those bad corporations, corporations are not people. So your pension plan owns that stock. You may own some of that stock. I mean, yes, there are foreigners who own that stock. That's your exporting the tax at that point. But it does affect competitiveness. So we kind of expect a two, which is effectively a two trillion dollar tax decrease. It's not really because it had just keep it the same. It's, it's, they keep saying it's a tax decrease. It's not really a tax decrease. It would just keep up going is what it would do. If it did sunset and expire, are we talking like would, like what would be different from a standpoint of it's my understanding that 1031s would look different. It's my understanding that like even life insurance and annuities could look different like what let's talk about the big provisions. Okay. So one thing that the people on the coasts would like is that the the non deductible state and local taxes, they'd be deductible again. But so would we get the alternative minimum tax back? So just so you know, that's a, that's all a fallacy to the state and local deduction because nobody really got it because of the alternative minimum tax. We got rid of the alternative minimum tax and we got rid of the deduction. It was pretty much a wash. And then we raised, by the way, standard deduction, go back down. The rates go back up. Bonus depreciation goes away. The 20% the biggest one is the 20% business tax deduction goes away. And that's huge. If you looked at, if you look at the numbers in the 2017 law, so there was a $1.5 trillion deficit in the 2017 act. Okay. A trillion of it came from reducing the corporate income tax rate and 500,000 came from the 20% small business deduction. So if you if you were to do a, so so you do have 500, 500, 500 billion dollars of potential revenue increase by eliminating that 20% deduction. So that's a big one. That's actually I think that's probably the biggest one. I think that's one of the best provisions because it's such an encouragement to small business. Yeah. They have that 20% deduction. And it was, but it was really a quid pro quo, you know, you vote for the corporate tax decrease. Yeah. Rate decrease will give you a, a business tax decrease. Well, and and Ken Keyes, who is one of the people that helped get that through, it was almost like, Hey, if we're going to help the corporations, we should at least pass down some type of benefit to the small business owners. Yeah. Marco Marco Rubio was heavily involved in that. Yeah. Thank you, Marco. All right. Let's get into your newest book. Maybe before we jump into that tax free wealth over 400,000, over 400,000 copies sold, which is remarkable. If you don't, majority people sell, what is it? Less than a thousand. Less than a thousand. Less than a thousand. They go through over five thousand copies. We sell five thousand copies a month. So you guys are like, obviously, when people think taxes, you're the number one person they think of period period. If you start doing research, you're the guy that is the person that's known for like being the godfather as it relates to being this guy. And a lot of people have used your book to come up with probably some crazy TikToks that make you want to throw up in your mouth. But with all that said, why don't you just give like the framework of that? But then I really want to talk about a book that maybe not everyone has associated with your name. And I think there's some things that you write in here that are remarkable. Thank you. So, so tax free wealth. So, so there's three questions that you need to ask yourself or your tax advisor should be asking you. The first question is, how do you make your money? That has a big impact on your on what you can do from a tax standpoint. That is the basis of tax free wealth. Tax free wealth, the whole idea behind tax free wealth is it's a it's a paradigm shift from the tax laws out to get you to recognize into the tax laws is a series of incentives. And and primarily for business owners and investors. Okay. So, which is, which is how I ended up traveling the world with Robert Kisaki is because he goes, Oh, I in fact, I remember where I was. I was we were on stage at the Paris hotel in Las Vegas. And we had about 200 people in the room. And I'm on stage with Robert. And I said, well, you know, that the tax laws, this is back in, oh, geez, this must have been 2011, 2021, and I said, the tax was really a series of stimulus packages because that was big, the big term right then right. We had all these stimulus packages coming out. It's really a bunch of stimulus packages for business owners investors. And I'll never forget Robert looked at me and he goes, really? I said, yeah, he goes, whoa. And that was the big shift for him. And he goes, Oh, well, then everything you're talking about supports what I do. I said, yes, everything I talk about that support, what you do. And that, you know, that's when we started going on the road. But tax free wealth really walks through the fundamentals of the tax law and what those incentives are. And that's the whole, that's the points to make it simple, make it easy to read. One of my, I've had, I have two favorite reviews of tax free wealth. One is it read like a spy novel, which I worry about that person. And what spy novels are reading. But the other one, I've actually had more than once, which is it was a great beach read. And to me, that's the best one because it should be easy enough for anybody and enjoyably enough that you could read it on the beach. And that's that's really what tax free wealth is. You know, like I say, in tax wealth, if you want to change your tax, you have to change your facts. And that's probably the quote that I'm known for in tax free wealth because you just, the idea of tax free wealth is to give you a choice. If you understand how the tax law works, and you understand that I can change my facts and lower my tax by doing that, then my decision is, do I want to change my facts? Yeah. But if you don't know that, you have no choice. You just have to pay high taxes. So that's really the fundamentals of tax free wealth. It's really a series of incentives. And here's what they are and lays it out. And it really focuses on business owners and investors. I remember when you spoke and it's still like to this day, you talk about this treasure map and the concept of like trying, like looking instead of saying, hey, I want to like just like be against the government, almost thinking like the mindset of like, why does the government give incentives? Why would they do? Well, why does potentially real estate have benefits? Well, think about it. If the government had to build it themselves, I mean, have you ever gone to the DMV? Like probably wouldn't have been done as good as what the private market could have done. And so they'll give the incentive, but it's not just like they're trying to bail out wealthy people. They're literally saying, this is better for the people. And so instead of us building in ourselves, you're doing something that's benefiting society. And it'll be cheaper for us to give an incentive to you than for us to build ourselves. And I think again, it's like, that's obvious to you. But I think there's a lot of people that don't connect the dots. And when you start understanding that of like, and again, I'm sure the stimulus was like when Obama was in office and you know, things, that is a great example of like, there's money out there. Go get it. But we got to figure out ways to provide value to get that. And so love, love that. And I think that for me has been a really big paradigm shift. And I appreciate that. So, so the same question that you have to ask yourself is what do you do with your money? And about 20 years ago, I started doing serious tax strategy work. I'd always done tax planning, but it was more reactive. But really tax strategy where you're doing a plan of action for revision of taxes. Well, I started doing that. You know, I always ask the question, how do you make your money? That that makes so much sense to me. But then I would ask the follow-up question, which is what are you going to do with your money? For entrepreneurs, business owners, what I found was 95% or more of them, the answer was, I don't know. I don't know what I'm going to do with my money. You know, I don't know not just the money when I sell my business, but the money that I make in my business that I don't have to put back in my business, what are you going to do with your money? And so we actually came up with a whole process for deciding how to do that. You know, what you should, what to put your money into. We're not wealth, we're not wealth advisors, but we are wealth educators. And so, you know, our our our CPAs actually walk people through. How do you figure that out? But the sad second question is a more important than the first question from a tax standpoint, because what you do with your money has a bigger impact than on your taxes than how you make your money. And so a lot of, for example, financial advisors, they're talking, they say, well, we do tax-efficient investing. Well, what that means is that you're paying less tax on the money on the earnings from your investments. That's okay. How do you make your money? What win-win-walt strategy goes through is seven investments that if you make that investment, not only will you not pay tax on the income, but it'll actually reduce your taxes from other income like your business or your job. And and the ideas, well, everybody who got their first paycheck and looked at their pay stub and they go, well, wait a minute, how come my check? I'm supposed to make $10 an hour. How come I only got $8 an hour? And they go, who the heck is this FICA person? Yeah. Yeah. Right? Yeah. And immediately they they realize, and typically you're 16 when you do this, right? 16, 17 year old, you get your first job, you go, wait a minute, why don't I get all my money? And what happens is is that you all of a sudden realize, hey, I have a partner in my in my in my job. I have a partner in my business because the government they're my partner. And and and so I actually embrace that in win-win-walt and I said, look, you the government is your partner. Now, here's your choice. You can be a silent partner and just pay go ahead, pay your tax. Don't worry about it. Or you could be an active partner, do the things the government wants you to do. And not only will you pay little or no tax on the income from those investments, but you'll actually pay little or no tax on the income that you used for those investments. Yeah. Right? And and and that is. So so I think of win-win-walt strategy as it as it's an investment book that shows you what are the tax not efficient investments, but the tax effective investments? Is it fair to say, Tom, that your first book was like, okay, we're going to we're going to show you the basics of like when you make money, how to keep more of it. And then once you have the money, now you're like the best way to grow your money with the same principles of and through through looking through exactly exactly. Now, here's what was interesting is I discovered as I wrote the book is it's fascinating when you're writing a book and you discover things so you didn't know. And what I discovered was that of the seven investments that the government highly encourages, they'll literally pay you to make six of them. The government makes more money by giving the incentive. Wow. Then if they didn't give the incentive because they encourage the business activity, they encourage the activity. There's one that doesn't and that's the one that everybody's okay with, which is the retirement plans. Retirement plans, the government breaks even. Retirement plans, it's a breakeven proposition for the government. Business, real estate, agriculture, energy, those are all the government makes money. Okay. The government's going to make money from that. I even life insurance, the government's going to make money as a result. Okay, because that money is going to be invested, right? And then there's going to be some tax liability at some point. There is some tax liability at some point. But with both retirement, they just break even. So that's why it's the win-win because it's a win for the taxpayer and for the government. And I think that's the mistake that that's the lack of information people have and why they say, let's tax the rich because the problem is is that if you were to take these incentives away, then let's make a perfectly good example of this. If you didn't have the tax credit for electric cars, would people buy electric cars? Yeah, some would, but not as many. If you didn't have the tax credit for solar panels, would anybody put on a solar panel? And the answer is no, nobody would do it because without the tax benefits, it makes no economic sense. You would never ever do it. Unless you just said, well, I want it to be good for the environment. And I think that's good for the environment. But that's like charity, right? That's your basically donating money to the climate, if you will. Okay, and that's fine. I'm no issue with that. But the tax incentives, what's interesting is it doesn't matter which side of the aisle you're on. Yeah, you love tax incentives. The government's greatest power is the power to tax. And in fact, little known fact, the reason the dollar has value is because you pay your taxes in it. Interesting. If you were not required to pay your taxes in dollars, it would lose it's, it would lose all this value. That's what gives it its value in the first place because you're required to buy law. You have to use dollars. That means you have to earn dollars. Yeah. Okay. The same thing is that's by the way, you have to, if someone owes you money, you have to be able to accept it in dollars. If not, the debt's canceled. Interesting. Yeah. Interesting. So, so, so, so, so, so, so the, anyway, so back to the wind and the wealth strategy, all ideas that look, this is, this is not a bad thing. This is a good thing. I actually think I don't think all incentives are good. Okay, I don't, that would be crazy. But these primary incentives, they all, they're not just good public policy-wise, but they actually are good for the, for the, for the treasury. They're, they actually increase the treasury for sure. Okay. So, if, if you're cool, I would love to go through these, these items quickly. And again, we will have a link in the description wherever you're watching this or listening to this. Please go get this selfishly. Like, if you can have the mindset of how you keep more of your money and then what you should be like the frameworks of how you should be investing, you will, you will thank yourself if you go do that. And obviously take 10, 10 seconds and write review after you get it. Help everybody. So, when it comes to, okay, the first, first investment is business. Pretty self-explanatory, I would believe like, but I just want to let you unpack business's first technology in a second. Yeah. Most of the incentives. So, so of the seven investments, five of them depend on business of some sort. Okay, five of them depend on business of some sort. So, what's interesting is, so we did, we looked at 15 countries. And how do these incentives compare from country to country? Because I want to go, I want to know, is it just the US? How? Right. Because people tell me when I, because I travel all over the world, I've been Kazakhstan for having sex. And people ask me, well, you know, they say, well, you know, that works in the US, but don't work here. I'm going, I'd like to know, does it actually work, you know, in not Kazakhstan, but does it, does it work in, does it work in France? Does it work in England? Does it work in Australia? Does it, you know, does it work in Japan? And the answer is, yeah, business is the number one incentivized tax incentivized investment in every country. 100%. So, it's, it's not a US thing. And obviously, there's good reason for that because you, business owners don't pay tax on their total income. They pay tax after deductions. Employees pay tax and their total income, they get no deductions. So that is the big difference. But what I illustrate and what was interesting, because I had not run these numbers until I wrote the book, you can start a business in your home. And the tax benefits of starting the business are often greater than the cost of starting the business. So the government literally will pay you to start a business. Literally, I mean, absolutely, literally, because you got income from somewhere else, you wouldn't be starting a business, right? So that income, the tax savings on that income are greater than the cost of starting the business. And only business has that kind of a, kind of a more than 100% impact. Well, let me add, so another way of saying that is you, you have to try to make money. So you start, you start a business, you're, you're, you're doing, you have a W2 over here. You, you, you, you start a business, not super profitable. You're not making very much money. Though you're losing money, the first, you're losing money, but you're able to make some deductions and you're able, like, that lowers your tax bill across the board. And so that's an example of that. Let me ask you this, there's a lot of people in this, in our circles that invest in their business, but it's like, it's like, when do you tell someone to be like, Hey, your investment, you're, you're delusional, like, stop investing in your business, invest in other things, like, because it's like easy to say, but, but like, how do you know when you get to a point when you're like, you should stop investing in your business because the, the returns are not what they could be. Yeah, and that's what you have to look at is it's, I always tell people, run the numbers. Okay. You know, as long as the return on the business is, and most of the time it is, by the way, yeah, most people as long as they can invest, reinvest in their business, as, as I'm talking about a profitable business, as long as they can reinvest in their business, that's probably a higher rate of return than any other investment for them. Yeah. That is typical. Normally, I mean, you can, 80, 90% returns on your money are not anywhere unheard of in business. They are unheard of everywhere else. Yeah. I'll use myself as an example, the where I'm at financially would not have been possible if I just took my $5,000 a year at, you know, put into my Roth IRA, nothing against Roth IRA. It's just my whole life is radically different and it's because I've invested my time and energy into thing that has given me the most leverage. And so a great example of that. Tech, what do you mean by technology? And you say, research and development, that would be investment number two. Right. So, so those businesses that invest in developing new new technologies, new new ideas, they end up paying very little tax. I mean, if you wonder, why did Elon Musk not pay tax for 20 years or why did Amazon not pay tax for 20 years? It's because of this. It's because the US like most countries incentivizes investing in research and development. Now, interestingly enough, going back to 2017 law, there's a provision in there that actually we would love it to run out because it you actually we lost some of the benefit of research and development. And it's a very bad law. It's actually a very bad law. And we actually incentivize research development less than most countries. Interesting. France incentivizes it more South Africa incentivizes it more. So most countries incentivize it. And most of them incentivize it more than the US does. But it's still it's big enough. One of the big one's is if you lose money in your business, you get to use that loss the next year against your business income. That's actually a big deal because you know, a company like Amazon, it lost money for many years before it made me the same with Tesla lost money for many years before it made money. Well, you don't want to be you don't want to be putting the brakes on those businesses and their growth. And if you taxed if you didn't allow that loss to carry forward, you'd actually put heavy brakes on the business because they'd have to come up with money to pay taxes, even though they've been losing money. And so what the government's doing is we always tell people that the job of our CPAs and our franchise is to raise capital from the government for business owners. There you go. That's our job. That's good. Our job is to raise capital from the government for business owners. And if you look at the research and development area, that's exactly what it's doing. It's allowing that capital to be redeployed without the burden of taxation. Is it possible to invest in this if you don't, if you don't have the business underline? Like could someone listening to this who doesn't have a business? You can invest in somebody else's business. Okay. That's fair. Yeah. Absolutely. And then that that utilizes this so that the third investment is real estate. I mean, just this is something that we could probably talk for a whole day on. So what would be your life? Let me be really clear. Yeah. We're talking about long-term rental real estate, not fixed and flips, wholesaling, that kind of stuff. We're talking about investment real estate. That's the investment. So whether it's residential or commercial or industrial, doesn't matter. Frankly, the tax benefits are similar from one to another. Low income housing does have some extra benefits to it. And in fact, the low income housing tax credit is purported to be the most important driver of low income housing being built. And one of the reasons we don't have enough low income housing is because there's not enough tax credit there. Because that's a very high risk proposition to build low income housing. But the low income housing credit can be as much as 70% of the cost of the project. Yeah. Over the lifetime. So it's a pretty big number. And so real estate has obviously enormous tax benefits. But remember, in order to get that, you really need to be in the business of real estate. So it starts with business still. And then so the nice thing about real estate, you get the business tax benefits and the real estate tax benefits. And it's one of the few asset classes that you can get leverage easier than others. Banks like to lend money on real estate. And I don't know if this is when we should talk about it, but you have this concept of buy, borrow, die. And I think it's interesting when we talk about life insurance. It's interesting when we talk about businesses and what Elon and those are doing, but also with real estate. Yeah. So so buy, borrow, die. It's kind of like playing monopoly, right? Forgreens houses. And then one red hotel, right? So so I like the idea of this, the 1031 or the light kind of exchanges where you start out small in real estate. You buy the, you know, small houses or small investment properties. And then you exchange them as they get more valuable and you get more experience into the larger property, say multifamily. And then eventually you're going to exchange it into something like a wall greens or a safe way or a wall mart where that's a sale lease back. They they sell you the building and they lease it back from you. And you get mailbox money, right? And then eventually you die. Well, so the question is how do I avoid tax all the way? Well, first of all, we're going to do the light kind of exchanges. That avoids the tax during during it. Well, but what if you want to money, you need money? Well, okay, A, you're going to get the income from it and that's money. But the other way you do is you can always borrow against it, right? That's the leverage you're talking about. So you borrow and borrowing is not taxable because you have to pay it back. Then when you die in the law as it is now, not in the Biden Harris law, but in the laws it is now when you die, that capital gains tax that you would otherwise owe goes away. It's it's called the step on basis, step up in basis and it goes away. So, um, by borrowed I is a it's a brilliant strategy because you literally take what would normally be a temporary tax savings in depreciation and you make a permanent. Yeah. The investment number four and five, you have energy and agriculture and so why don't you unpack that quickly? Well, so energy interesting is in the US, it's both renewable energy and fossil fuel energy. They're both highly tax incentivized. And in fact, if you put the nice thing is it actually built. So solar energy is nice because it's best if you put it on your office building. So if you own real estate that's investment. So you're using that investment and then you put solar panels on it. Not only do you get a 30% credit, but you actually also get the depreciation deduction. It's amazing. Yeah. Literally the government will contribute over 50% of the cost of those solar panels and batteries. And I've I've done it on my on my properties. And of course, I live in Arizona. So we get lots of sunshine and our electricity bills in the summer are really high. So solar energy makes all the sense in the world in Arizona. And when the government is paying 50 to 60% of it, why not? So that's the solar side on the fossil fuel side. Interesting enough. It's investing in oil wells, oil and gas wells. And again, not exon stock oil and gas wells. But if you invest directly in the well, you get what's called intangible drilling cost deduction. And it'll be up to 80% of your investment the very first year. And so if you put in $10,000, that's an $8,000 deduction. Well, the difference here between fossil fuels and real estate is in real estate, there are things you have to go through in order to get those deductions like being a real estate professional or having passive income, things like that. That does not apply to oil and gas. So oil and gas has a carve out exception that even if you're an employee, you can take the deduction. And even if you have nothing to do with the oil well, you just invest, you can get the deduction. So there are, I will tell you, the biggest investors in oil and gas are probably doctors. Interesting. And let me ask you this. Obviously, neither Tom or I are giving tax or investment advice don't, don't sue us. The that sounds great. I know people personally that have lost money, not because of the tax credit, but because the actual oil deal went south. So what it would be your two cents on just the due diligence to make sure that you're doing it like, first of all, don't ever let the tax tell wag the investment dog. Okay. You make an investment because it's a good investment. It's going to produce cash flow. But don't forget the tax side of it. So, so you're looking at, what's my after tax return on investment versus my after tax return investment? So for example, you invest in the stock market, you get no deduction upfront. So your and then your income is probably either capital gains or dividends. So you're getting probably a 20% tax rate, right? Okay. But no tax deduction going in. And then when you sell it, you or you get dividends, you pay tax on, say, oil, you're going to get say 40% of your money is going to be contributed by the federal government. So that means you're after tax, you're really only investing of that $10,000 or $10,000. So you return on investment is that much higher. So it just increases your return. It doesn't cause your return. That thank you. And again, it's just like any of this stuff. It's like real estate's a great example just just because real estate's an amazing asset. Why do people lose money on real estate right now? It doesn't make it. It doesn't make it just a bandaid and everything goes away. So and then would you say agriculture is like, what's the potential by the way of all of them agriculture is the best. Amazing. Okay. I got one. I just never met a farmer or a rancher who pays tax. Yes. Okay. I'm from Wisconsin. And there's a lot of farmers that I wouldn't trade places with. No question. What is the most important commodity that is produced in any country food? Food. Yes. Right. Food. And so so plus what is the most risky business in the world? Agriculture. Yes. So you take those two together and the government's just saying, look, we're going to give you all sorts of incentives to do this. There are specific incentives for different types of crops, which is bizarre to me, but there are. I mean, like Christmas trees. Did you know that you sell Christmas trees? It's capital gain. Okay. It's not inventory. It's capital gain. Interesting. But you get to deduct all of your investment. You get to deduct. Right. So you invest your deducting all your investment into the seedlings and into the fertilizer and into take care of them. But when you sell them, you get capital gain. So I actually, I can actually use this example in the book is a Christmas tree farm or a winery, right? A winery. You put all that money in. It's a high risk. I mean, you know, you think about those, those wine producers in Napa Valley. And when all that, that when they had the big fires and they they lost, they lost whole crops because of that. So it's a it's a highly risky business. It's a highly risky business. The government's just basically saying, we'll let you make your money. We're just not going to make you pay a lot of tax because we want you to do it. If you don't want to invest directly in like a farm or a winery, is there a world where you can like like oil and gas and put some money, but still get the benefits of tax? Yeah. I mean, you'd you'd have to find a farmer or rancher who was expanding that needed capital and was raising money. So it it it'd be that kind of a no. Okay. Okay. Let's talk about let's talk about life insurance. Obviously, our audience are audience knows a little bit more than the average person has really so life insurance. You're by borrow dye also relates to this in almost absolutely an amazing way. But I just want to like from your perspective, what is your thoughts on using life insurance as an asset? Hey, it's Caleb Williams here. I'm just interrupting this video quickly to invite you to check out our an asset vault. You may have been there. We've actually revamping it. And if you are somebody that wants to learn more about is life insurance right fit for me? Does this and that's it makes sense? Like does this actually help me be more efficient? We've put together a 10 minute documentary style video that I can test a really really good job giving the history why the end asset different setups and designs that we use. And then we have an an asset vault that gives like case studies, calculators, handbooks and so much more. We are here to serve you whether it's a conversation, whether it's education or the video. So make sure to go check out and asset.com slash bolt. Learn more. You call it an investment. I almost see it as a storehouse to be able to invest in other areas that you've talked about in this book. So there's a lot of reasons for life insurance. It's I don't think there's one just one reason and and you know, a lot of people like me, I will probably never borrow use my life insurance policy for a long. I probably won't. Okay, I don't need to. Okay. And but I'll tell you what some of the great tax benefits are of course is first of all, it's public policy is what allows life insurance, all the tax benefits. It's that look, we're trying to take care of widows and children. That's really where it comes from. And it's good public policy. It's not unusual in different countries, although I think we're a little more aggressive with it than most countries. And but you have of course two types of policies. One is a term policy. One is a permanent policy. I'll call permanent. There's whole life, et cetera, et cetera. But it's a permanent. And the way I explain the difference is once in expense and once in asset. And that's really somebody wants to explain to me fact, somebody I know, I'm sure you know Patrick Donoho. Yeah. He went one day he told he was telling me he goes, I said, what percentage of term policies are collected? He says less than 1%. What percentage of whole life policies are collected? He says over 97%. I'm going, okay. So here's what you're going to say from now on, Patrick. Term is an expense. And and whole life is an asset because that's the case. Now if you just want to have an expense, then term is fine for you. But what I, I think there's some really good uses for whole life. One is of course, as you've got that cash surrender value. And you if you need that loan, you can always get that loan. Okay. Another is of course is that it means that if you need to, if you want to take care of people when you die, that means that you have an asset and you can spend all your other assets. And you don't have to worry about leaving your assets and and and living less of a life so that your assets can take care of them. You can let the life insurance take care of them. And I think that's a huge one. From a tax standpoint, there's no deduction to buy life insurance. However, yes, there's no income when you receive the beneficiary gets the life insurance. There's no income. Certainly when you borrow it by borrow die, there's no income. On top of that though, if you borrow, if you use this collateral, because again, you're not borrowing from the policy. You're using the policy as collateral for the loan from the insurance company. That's a very big difference. And then people know what the the reason is important for people is if you let's say borrow from your Roth IRA. The interest you pay your Roth IRA is not deductible because it's not taxable. So that's a non deductible interest expense. With life insurance though, you're not borrowing from your policy. You're borrowing from the insurance company with the life insurance is collateral. That means that if you use that money for say real estate or for business, the interest is deductible as real estate interest or business interest. And so the interest income, say this is what I love, the interest income is tax-free because the policy is still growing. And the interest income on that policy, if you hold it until you die, is tax-free. But the interest expense is tax deductible. So you actually get some tax leverage here by borrowing that money. And you don't lose anything. But it's a debt like anybody else. And you are not paying yourself. You are paying the insurance company. And a lot of people mix that up. They make it almost sound too good to be true. And usually it's too separate. It's like your cash value and your death benefit are growing pretty much regardless. The fact that you utilize your policy, you want to make sure that that activity makes sense as well. It's not just all in one bucket. You are, there is a debate. And it's interesting because there's not, it's like a lot of things in tax. There's not like it's not super black and white. But you're saying even there's some people that say you have to have a third party lender to have it be tax deductible. But you're saying, if you can prove that it's business purposes and you're right, you're working with the insurance company, you can write off that interest. No, so here's the rule. And I tell you, I was in the national office of Ernst and Winnie back before it was Ernst and Young when the interest deduction rules came out. And we actually testified before treasury on these interest deduction rules. And I got really, so I have firsthand knowledge of how these interest deductions rules work. It's a tracing principle. So you actually any, any loan outside of your home mortgage, any loan outside your home mortgage, the deductibility of that interest depends on what the money was used for. Got it. Okay. So in this case, the reason you don't need a third party lender is because you're not borrowing from your policy, your borrowing from the insurance company. And the insurance company is a third party. Yeah. You're not borrowing from yourself like you are with a Roth IRA or Rothfrohn K, excuse me, Rothfrohn K, you're borrowing from the insurance company a third party. Yeah. I don't think there's any question. It's deductible. And I think there's just so much misunderstanding as it relates to that because most people don't need to use language well. And so they're of course, people might get it mixed up to say, it's just like your Roth IRA, but you're totally right. There's a there's not so yeah, I don't like your Roth. No. And I again, appreciate you writing this in the book and even just your understanding around it because as you know, that sometimes life insurance gets a bad rap right, rightfully so by the way, there's, there's, I don't endorse neither to you all the things that happen when people talk about life insurance, but it's it can be a great asset. Well, and I got to tell you, I think the most creative people on earth besides lawyers are our life insurance people because they keep coming up with new ways to sell life insurance and it just cracks me up. I'm going, oh my heaven, you know, some of these some of these things that they're you that they're saying work, that'll work, okay? And so just because life insurance done the inner works. Yeah, so I do have to make sure, particularly some of these more extravagant things. I mean, you know, a big big term right now is ppli, right? Private placement life insurance. There are there situations where that works, but there are a lot of situations that are being proposed by aggressive life insurance agents that do not work. In fact, the IRS is going after them. Yeah, because of that. Same thing with people borrowing money to pay life insurance. It can work based on your situation, but all the people that were pitched these sexy illustrations and now with interest rates going up. It's like again, it becomes very problematic. Last but not least, you have retirement savings plans. I want to again, thank you for just spending the time. And this has been amazing. I there's a lot, I have like a list of like, hey, we're going to have Tom back on and we're going to talk about the TikTok tax things that make you want to throw up or other things, but I want to just end on this note. And then hopefully we can have you back on and and jam about some more things. Yeah, well, let me put it really. So one thing I learned, probably the most important thing I learned writing this book was that IRAs and 401ks do work from a tax standpoint, because what happens is is you when you get a deduction, it comes off your high straight, but when you get the income, it's spread over the different tax brackets. So do, I do want because I kind of had to eat my own words on that because I said for years and years, it doesn't make any sense unless you want to retire poor. That's not really true. If you retire with the same amount of income as you had when you were working, you're still better off net, better off. Okay, I want to be really clear on that. But the same thing that I want to be clear on is that a investing in the other six as a retirement plan is far better than investing through an IRA, 401k pension plan, usually. And the reason is is because you get a you get that big tax deduction up front and buy borrowed I you may never have to pay the tax. So on the on the IRA, your paying tax at some point, either it's a Roth IRA and you pay tax before you put the money in or it's a regular IRA and your paying tax on the money when it comes out. So one way or another, your paying tax on a in real estate, you may never pay tax. Same with same with same with same with oil, you may never pay tax. I mean, some of these other investments, you may never pay tax your business. I can show you how to start a business, build a business, sell a business, never pay tax. So just know that while yes, it works, it doesn't work as well as the others. No, I appreciate it. Appreciate you saying that. I agree. And it's interesting. You can say that and then we also what we even opened up the show, there's if people raise taxes in the future, you're the deferring your post-pony. You're deferring into a higher bracket. And the fact that inflation is happening potentially means again, you have to spend more money just to maintain what you're currently spending today, which potentially means you're going to be paying more taxes. But you're 100% right. And they're I mean, deferring versus paying, there is momentum that gets built up. And so Tom, thank you. Thank you for taking time to write. Thank you for taking time to set the record straight. And I will also include your YouTube channel and any other links that you want me to have. And if there's any if there's any call to actions that you have, we'll have your your books, your YouTube channel. If you watch me, you're out of your mind if you're not going to go subscribe to the tax goat himself. But is there any final words that you want to leave on? Yeah, first of all, I'm website is tfwadvisors.us. So I will throw that out. But the most important thing is not don't be afraid of it. Most people are scared to death of money. They're scared to death of finance, mostly because they've been taught to be afraid of it. Taxes is perhaps the scariest. And you know, people go, well, death and taxes, right? They're both inevitable. Well, taxes are certainly not inevitable. And death is becoming less and less inevitable. So, um, but taxes are definitely not inevitable. And so it really comes down to getting educated so that you have a choice. Now, you don't need to be educating all the details. That's what your tax advisor for. That's why we have our franchise of tax advisors is so you don't have to know all the details. You do have to understand the principles, which is why I wrote tax free wealth and when we're not strategy, because it has to become a strategic decision for you as to what am I going to do? And what because if you are willing to take charge of your life and your finances, then you can wait way more money still by paying a lot less tax. So how many fiction books or books in general can you read and know that by knowing these facts and information at like the compound effect? I can't think of a better compound effect than understanding the tax code as relates to how you make money and how you invest your money. Tom will write thank you. And until next time, we will include the information including your website down below. And I'm grateful for you and I hope you have a safe and then full not hopefully not too eventful rest this year. Thanks a lot, Caleb. Appreciate it.