Welcome back, Rocky DeFrancisco, to the BetterWealth show. Recently, I received a defamation notice from Curtis Ray's legal team, which prompted me to take down a video featuring you. However, our goal today is to explore the situation in a transparent manner without speculation.

Key Points Discussed

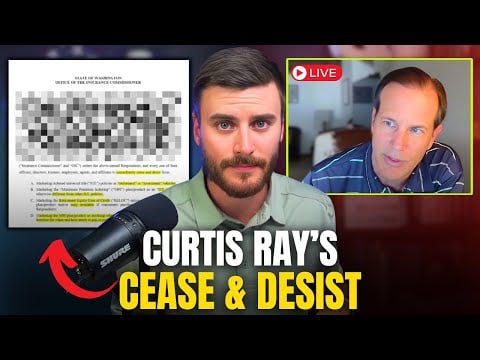

- Curtis Ray's marketing strategies and the cease and desist orders from the state of Washington.

- The implications of selling Index Universal Life (IUL) products, specific marketing claims, and potential legal ramifications.

- Insight into the concept of 'Hyper Funding' and its associated risks.

Background on the Issue

Rocky, can you give us your professional insight into the primary issues concerning Curtis Ray's marketing approach? You’ve stated it mostly involves opinion rather than fact, but there's considerable concern surrounding the marketing of these insurance products.

The Case of Curtis Ray and Washington State

The state of Washington issued a cease and desist order based on how Curtis Ray marketed IUL products. This stemmed from an insurance agent's complaint, alleging fraudulent marketing practices. The main points include:

- False claims of uniqueness and exclusivity in the IUL product marketed by Curtis Ray.

- Misleading terms like "holistic retirement plan" and "superior retirement income" which were not substantiated.

- Use of terms like "relock" and "internal leverage" which were seen as deceptive.

Lessons for Consumers and Advisors

There are several lessons here for both consumers and insurance advisors:

- Understand that terms like "investment vehicle" should not be casually used in insurance contexts, as it misrepresents the product's nature.

- Recognize that comprehensive disclosure of risks and benefits is crucial in financial advising and marketing.

- Advisors must be cautious in how they market insurance products to avoid allegations of fraud and legal scrutiny.

Conclusion

As we await further updates on the case and Curtis Ray's responses, one key takeaway is the critical importance of ethical marketing and clarity in financial product offerings. For those interested in understanding the full scope of the cease and desist order and how it impacts practice, please download the document via the link provided below.

Special Update

Watch the video below for a special update at the end for followers of the Curtis Ray series. This new information could prove vital for both professionals and clients in navigating these complex waters.

Full Transcript

Rocky DeFrancisco, welcome to the betterball show. Thanks, Jell, thanks for having me back on. I made a video walking through the defamation essentially letter that I got from Curtis Ray's legal team. And what I shared at the end of that video is I'm taking the video down that you and I did, just because I don't necessarily want to fight in the legal court. But what I did say at the end of that video is that I was going to have you on. We're not going to speculate. We're just going to go black and white. What has happened since we recorded and Washington, season to cysts have happened. I believe you have two documents. You shared it with your new your newsletter of over 50,000 advisors on September 16th. And and you're kind enough to come back on and we would like to go through this. So I don't know if there's anything that you want to say before we jump into the document. But I know you have your opinions, your thoughts. I will also say that if you stay to the end, I have a very, very special update for people that are following the Curtis Ray. You know, videos that I'm doing, I have a very special update to share with you at the very end. But is there anything that you want to say Rocky as we set the stage? And then I don't think if there's a better person to dive into this and go through this than you. And then we're giving people that watch this video, the ability to get the same documents that you have down below. So if you want to follow along or get these documents, you can check out the link down below anything you want to say before we jump in. I know just that, you know, I liked our other video. I don't necessarily blame you for taking it down. It's more of a cost benefit analysis as to whether it, you know, I don't personally think there's anything wrong with our video or anything. The Famous Orient it was mostly opinion and fact. But, you know, whether somebody chooses to sue your not as an attorney, I always kind of welcome those because I don't have to pay attorneys to defend myself. So I always had a lot of fun with those because I would get those kind of emails or letters from. I got one from Ken Fisher when I put out as a newty guy. I actually got one from Robert Castellano when I started calling people leaper. So I've got those letters just like you received them. I'm like, you, I'm like, giddy up, send me, send me to laws it. I'll put on the front of my website. And then I also have you spend $50,000 or I don't have to spend $50,000. But I get it. And I don't blame me for for taking it down. And this is really going to get us where I want to go anyways, which is really just talking about what the issue is here. Yeah. I think before we jump in big picture, this is just your opinion. You summarize your biggest problem with with Curtis Ray and his marketing. Why don't you summarize that? This is your opinions, not a fact. And we can go into black and white what actually happened in Washington because I find that would be really interesting. And then we don't have to speculate. We can just see what lessons we can learn from from that. And I think regardless of who you are, there's lessons to be learned. If you're in this profession or if you're a client to somebody, I think you can learn a lot by by what we're going to go through in this video. Yeah, I definitely think consumers and maybe even more so advisors can learn from what we're talking about here. But I mean, look, the reason that he got sanctioned by a got a cease and assist by the state of Washington was the way that he marketed. And that's what we're going to go through in the in the documents. So I'm expanding much on that is I'll do it as we go through the documents. But you know, the concept of what he's pitching is one that I've been warning advisors about for nearly 20 years. Warning in the sense that I've actually never seen it sold in a full disclosure manner. And I don't know how you know, I obviously we know what Curtis is marketed because he got a cease and assist by the state of Washington on how he was marketing. You know, I've never talked to a client he's pitched it to, but very rarely are the pros and cons of this concept that he's pitching disclose to the client. So we've taken an I you all product index universal life. And we really kind of considered a no risk product. I mean, could you lose money in a way can't lose money because of downturns in the market because the floor is zero. We hope that we're going to get our gains locked in every year. And so this is an I you all video per se, but we will take this no risk product and then we're going to add risk to a by adding leverage. We should do another video on premium finance life and all the ones that are blowing up out there. This is sort of self premium finance life in a way. So the concept I call it hyper funding. It's been around for again over 20 years. I think I say this on the last video. I know the guy pioneered it. His name is Jeff Cohen as soon as these products came out. I give him credit. He figured out how to manipulate them to potentially get a better outcome. But to get that better outcome, you have to take risk to do it. And I don't want to take a no risk product and turn into a risk product. So there's a lot of things I don't like about the concept of hyper funding. Could it work out? Sure. It could. But it also could work out to sit the clients detriment and depending on the policy you're using and the terms of that policy that could be even more danger to it, which again is outside the scope of this this presentation. But I personally do a warning newsletter on the concept of hyper funding every couple of years to my database of advisors and and sort of ironic that now we're talking about it today again. I'm at a different setting and and to go through the state of Washington orders. I think we'll be very interesting. Cool. All right. Let's dive into the state of Washington's orders. All right. So you can see my screen here. So here we go Curtis and his company and sure enough, this is a real live order. You know, it's got it signed by the by the department of Washington's insurance department. And this is the original one. So this is the original cease and desist. So this is with the state of Washington would send out to somebody say, Hey, we don't like what you're doing. We'd like you to stop it. And then we'll deal with the consequences of that throughout throughout the process. So you know, we have it. I've highlighted it here. So again, if you want to click on the link below this video, you can download this. You'll get the highlighted version because I'm just trying to save people from reading the whole thing and getting a big fat headache. So so here's our companies are people that are dealing with this is the insurance company that has been used by Curtis in the past. It's not one of the companies that we typically recommend ourselves. And as far as I know, it's the only company in the industry that allows Curtis to sell these now. It could be wrong. If you want to ask them that that's up to you. But I don't know of any other company that's doing this. In fact, several companies that we deal with have a standing position internally that they refuse to allow their advisors to pitch this. So whether it's Ali answer some of the other companies out there. If you call them said, Hey, you know what I really want to do is I want to go pitch clients hyper funding. They would say, No, no, we prefer you not do that. In fact, if we find out that you are doing that, we're going to terminate you. So that really should tell the consumer a lot about, you know, because insurance companies law premium. And this concept is very sexy. If I could make this look awesome on paper, which typically would mean that insurance company would green light it because it can bring in more premium. When in fact, this is one of the few topics that the insurance company said, No, we really don't want this because it's it could be a recipe for disaster. It also could buy the will bring in more regulations on the illustration side as well, which is a secondary issue. But so as we go through the the department of insurance opened up an investigation, which was interesting because it came from an insurance station. That's really interesting. And maybe not as interesting to the consumers watching this, but if I'm an advisor, what does this mean? Careful how you market yourself in your local marketplace. If you do the things that are on the edge or that another advisor might consider underhanded or in this case, they they alleged that the advisor was perpetrating a fraud, which is one of the worst terms. You can be associated with in any industry, whether I mean, what's the industry I wanted to spare as card dealers, but you know, what's the one industry we expect you know to be shoveled a bunch of jog by a salesperson. It's the car industry. Well, one that's not two five behind us, the insurance industry, and you know, the trust level of a CPA is very high. I'm an attorney not everybody likes attorneys, but there's a trust level with attorneys as well for the most part. The trust level is much lower with insurance agents, so having fraud associated with your name is not a good thing. So the insurance agent alleged that there was being a fraud put on the consumers across the nation by disguising an index universal life policy as a Curtis Ray product. There's nothing unique about this product. That was part of the problem that that the department insurance had on had, which was. Well, you know, he's kind of marketing. This is something very unique in somebody can only get through Curtis Ray. In fact, any insurance agent who gets licensed with mutual volma can sell the same exact product and assuming that mutual volma allows it, sell the same exact way. And so that was part of the, obviously the fraud, the, the deceitfulness if you will of the marketing. So mom is going to go through roots on these highlighted areas. So it's not a, this is from his marketing. It's not a typical type of life insurance policy. Yes, in fact, it is. It's exactly typical as many of the other ones. In fact, I would argue if you wanted to do hyper funding, there's several other products in the marketplace. If the company allowed it would get a much better outcome than mutual volma, which is totally ironic. But that's for another day. So we've got some compound interest. We've got I wall 2.0. When you say I put I wall 2.0. It sounds like something unique. Again, it's not unique. Yeah. We have just no features and benefits that currently found our other policies. Ron. You can find them in any policy, including the one that you're using. They also didn't like the term holistic retirement plan, which I, which I think is very interesting, especially for the insurance agents, who have a habit of calling. Cross value life for retirement plan, whether it's all wife or variable life, although I think maybe you get away with it a little more variable, but or index universal life. In the universal life is not a retirement plan. It's a product that can be used in the context of a retirement plan. It is not a retirement plan in and of itself. The Department of Insurance didn't like that. A superior retirement income. No, it's not superior to anything else. In fact, I would say it's inferior to other products. If their company is again, would allow you to do hyper funding. It can't be overstated. The power blah blah blah. They didn't like the term relock, which is basically wrote relocating money that you're going to borrow from the policy and put back in and premium. They didn't like that internal leverage. Internally, internal leverage. They're telling us stop using his term relock. No other retirement plan that don't ever say that. No other retirement plan can provide this benefit. First of all, A, it's not a retirement plan and B. You know, what if I get my calculator out and I do a whole bunch of other planning with a whole bunch of other stuff. You'd be surprised at what I can come up with to show you that something else may, may in fact, look better than this. So these are these are the things that the Department of Insurance in Washington didn't like about how he was advertising. His plan to the consumers of the state of Washington, I think mainly through through the internet. So, OK, investment vehicle. Never ever, ever use the term investment vehicle with a fixed product. It's not an investment. It's a fixed insurance product. And in fact, that's a great way to have everybody come down and you and it's cleaning the state securities department. So don't like using that term either. So let's see what else we have here. And that's something that if people follow this channel for a while, like they probably rolled their eyes because I constantly say like insurance is not an investment. But the reason we highlight that it's so important to because there is a lot of people in whole life and I you well, believe it or not, that try to pitch it as an investment vehicle. And I get what they're trying to do is they're the same thing that Curtis is trying to do is like talk about like even when he's using language like this is not a typical or this is superior. He's what he's allegedly saying is like, hey, when all these benefits are working together, it gives you a quote unquote better outcome. But it's like, yeah, it's it is really apples and oranges, right? That's what you're getting as like with an index universe life policy, which I I love it as an asset class, right? It's just an asset class. You can buy real estate. You can buy investments. You can buy cash value life. You can buy an annuity fixed or variable. So I love it as an asset class. But it's just that it is not investment. So I think you're right on point to to discuss that in your other videos with with advisors as well as consumers. So interestingly, I'm guessing this is the client that this advisor made the complaint found and why they made the complaint. I don't know that for a fact, but I'm guessing that here. So what is the saying here that this pod this plan, the strategy was sold to a policy older one year later. Of the clients said, hey, I don't have money to fund this thing. And by the way, I also buy policies on my kids and I can't afford it for them either. Now I would love to learn what now we were told by this document that a mutual client that client was unable to obtain a refund. I don't know if that in fact was the end conclusion. If I was mutual of Omaha, I'd have been stroking this check back to the client to get out of the lawsuit that could possibly come. But I don't know what ultimately came from that. But it's interesting to note that in this complaint, it can't really it seems they came from a client who got sold this concept didn't have the money to fund it. Unfortunately, bought it on their kids as well. And it's really going to get a bad bad outcome. And I also just speculate on something here. Sure. Is we I see the premium is it 4,000 is that the premium that was paid. So again, one of the criticisms again, there's a difference between a credit investors, people that have a lot of money versus people that maybe aren't accredited, maybe don't have a certain network, don't make a certain amount of money. And there it's one of those things where you don't a lot of times these regulatory agencies don't just look at the net dollars, they look at the sophistication of the person. And what this shows is you mentioned that hyper funding can be a way to do premium finance, but internal in the policy. And a lot of times these insurance companies, whether you like it or not, I would love to do a video with you about premium finance and some of the potential flaws in that. Is they have a certain that worth meant like a lot of companies you need to have like a 10 million some of these companies are pushing it up to like 15 million dollars and that's their way of saying, hey, we'll entertain this, but we want you to have a ton of money to be able to if something doesn't work out whether the storm. This shows me is this I'll just say allegedly this person at $4,000 premium probably is not in the same bucket of being worth 15 million. And as a result, I know that in the past there were videos that almost made MPI as like the sole solution and you can see where people exactly all their money into this and that is one of the other issues is like yes, this hyper funding potentially work. Yeah, I mean, there's a little drop that were quickly, which is right here that I have on your line, the best retirement possible, right? So if it's the best retirement possible, why would I want to fund anything else? Yeah, I put all your money in that and that's that's the and that's what I ultimately like opened up our initial interview on is when anyone overhives anything to like be careful and back down trouble. But at the end of the day, it's like there's no magic bullet and and that that should be a good lesson regardless of where you're like, if any, if any investment, any insurance product, if anyone's coming to you, be very careful if you hear that this is the end all be all because most likely time will be the greatest equalizer and it won't turn out. So I'll you get back. I just know it's like my mini soap box. Yeah, no, it's all they're all good points. You have secured your retirement dream. Apparently that lady had not secured her retirement dream, right? So, you know, look in my normal day job when I educate mentor advisors work with consumers, you know, I'm not a huge fan of asset allocation, the securities market, you know, stocks and bonds and those sort of things. But I'm a huge fan of allocation of your money, meaning what? There's nothing wrong with cash value life as a bucket. There's nothing wrong with real estate as a bucket. There's nothing wrong with stocks. Do you know what I'm saying? So when I do talk about asset allocation, I broaden that outside of the securities industry to say other things. So nothing wrong with any bucket. But what I see far far too often, especially that's even more problematic with older clients when you're using any kind of cash value life, including index universal life. Man, if you ran into like a 55 year old, I can make it look good on paper. I could just can make hyper funding look even better on paper. But if it doesn't work out for 55 year old, and this was their savior to make up for all the lost time and it was the one that didn't work and it was what they mainly funded. First of all, I think the agency gets sued, but that really has screwed up that client's life. That's why I don't like to see IUL sold to older clients. And I don't like IUL sold as the solution to the end to the end all BL. So let's see what else we can do here. So now we're going to get into the statutes, if you will, of what they, what the state didn't like, you know, the statutes says we're going to provide advertisements that she'll be truthful in misleading. While the fact that we're having this discussion means that the state of Washington thought that these ads were what? Not truthful. And that they were misleading. That's why they got that's why he got the season to say so. You know, these are all problematic, you know, things that I have a tendency to mislead. What got this thing started was the unfair competition angle right here in the middle that he's creating an appearance of what he has is something unique when it's not and it's really an unfair competition against this fellow insurance agents and financial planners. That's really we got the bomb moving. So want to avoid things like that, of course, a deceptive, they're prohibited by the code. Let's see what else we got here. Things that are false. I mean, again, you just don't want these things associated with your name, but they will they will stay with you for a long, long time misrepresentation is an awful word, right? So ultimately, the state is saying that the ads were dishonest that they were coerced the course of that they were creating an unfair competition against his fellow competitors. And that the state basically said, look, you need to stop this right now. And we want you to strip all the stuff off your websites, clean everything up, and then we want to give you a fine. And in this case, they were looking for a $10,000 fine. It should be more than a thousand, but there's your $10,000 fine. So what ultimately ended up happening, at least just minor standing of it, is Curtis did the best job. I think he tried to scrub his websites. Now that was a big undertaking because that was the majority of his websites as far as I understand it. I mean, he had so much stuff on there that drove home his narrative and he's an awesome marketer. He got a given the fact that he's an awesome marketer. So he was supposed to go ahead and scrub everything, take it all down from the web, pay his fine, and then we move to the next document, which is this is the consent order. Now it's going to rescind the season to assist. What does that mean? It means that the court is going to take Curtis at his word that he took all of this stuff down that he is complying with the laws of the state of Washington from from marketing perspective. So he's going to allow him to go back and do business as long as he pays his fine. So that's what ended up happening now. Ironically, you know, I've had some email back and forth with Curtis because I was allowed to give people an opportunity to comment on stuff. And it took me literally literally less than five or 10 seconds to find stuff that I would think that's still on the web that violated this order. I don't think he had it up there on purpose, but I even know him like you, dude, do you know of these things around the web still and I think this violates your order, your consent order. I'm not sending this to the department insurance because I'm not really something I don't care, but that's not what I do. And I said, you might want to go find the stuff and he's like, well, where did you get that? I'm like, well, you know, I just found on the web, you know, Google yourself and only takes a minute. So ultimately he ended up taking down the stuff that I found as well. So I don't, my guess is that he's made a good faith effort to comply with this order, which is great. At least we'll hope. But in my opinion, well, not my opinion, my hope is that it curbs his ability to sell the stuff. I mean, you know, he's not necessarily a competitor to me. I don't work really in his space, but I don't like hyperfunding. So I don't think it's sold typically in a full disclosure manner, which is really what this complaint is all about. So I would obviously go away. I'm sure he'll still make a living. I'm sure the hill still tout this is the greatest things in sliced bread, but we'll try to do it within the confines of what this order says. And then ultimately, if you want to know, basically this stuff is just reiterating what was in the other order you get to the end. And then you have his signature, his doc you sign where he has agreed to this. He's agreed to the fine. And there you have it. So we have a national marketer of index universal life being shut down from marketing perspective by a state department of insurance. We have the insurance agent agreeing that his marketing was misleading and false. And he took it down and he paid his fine. And that will see what the industry thinks of what he's doing going forward. A couple of questions. The $10,000 fine. Is that standard? It seems arbitrary to me, but what in the past, because you've. I think it's actually quite standard. Okay. Because I've read a lot of other orders like this, not necessarily the same as this one, but where the fine typically happens to be $10,000. And now as one of them was one that really will get people's attention and the insurance agent market is when you're when you're founding a fixed insurance product, I'm at a fund in an extinuity. I'm going to find an extuniversal life product. Where did the money come from? What do you mean? Where did the money come from? Well, where did the money come from? Did it come from the clients bank account? Did the client have to sell securities to fund the fixed product? Huh, that's an interesting question. So there's been fines in three different states. And usually there are $10,000 now as where they were finding insurance agents because the money. They they they they state said they violated the source of funds rule and the source of funds rule is just what I asked. Where did the source of the funds come from? To fund the index to do it here fund the next life product. Well, I came from the sale of security. Well, we think that matters to source of fun rule because you don't have a securities license and they find the agent 10 grand. So it's it was a number that I see quite often. It was it's interesting in the in the letter that I went through in my other video. Time stamp 1546. We talk about you talk about the calculator and you have some choice words on it. And one of the points that they said that the reason that this is misleading is that the calculator reference is not currently shown on the MPI website. Anywhere else and I kind of chuckled I don't I'm just assuming that was one of the things that they took down through this process. Do you have a comment on that or use my assumption? You think I accurate or do you think it's just a coincidence that they're no longer showing that calculator that we saw at the time when we did the video. Actually, what I what I had a email exchange with Curtis, I thought he said that he took down the old one that he had, which was supposedly telling a client what they might be able to expect. And I thought he put up sort of a more generic one. So I haven't been knows I haven't been his website lately, but I think I'm pretty sure he took down the what we're sure. Yeah, exactly the one that we were referencing. And I think maybe he's got more more generic one up. But I haven't been there to check it out. We will have both of those links down below or we'll have a link down below for for you to be able to check out the documents that we covered. The what I wanted to share just with everyone watching is two Curtis's credit he did reach out to me after the video of my initial video just responding to the letter that I got from his attorneys. I expect to have him on later this week. And so I just wanted to set the stage of if you're if you're following this channel, if you if you subscribe to this channel, you'll make sure to see that when that drops. I'll be able to ask him about his legal letters of defamation. And I'll also get to ask him about the Washington season to cis Rocky, is there any questions that you would like to indirectly ask Curtis. I can ask on your behalf. Is there any questions that you would ask? I'm probably I mean, you're just going to go over the ABC's of the ones that the answers that you're looking for are questions like, you know, did you know, it was false? Did you know it was misleading? You know, we obviously you agreed that it was false and misleading and deceptive, right? That's your leading question, which is very difficult for somebody to come out of their mouth. Yes, I put out false misleading deceptive content. It's hard for somebody to say that, but that's essentially what he's agreed to in the order. I would you know, I would do that. I video just for fun, but I don't even I don't even need substantive questions asked Curtis, you know, I've been on software. I can run all the numbers he's running. You know, I've been doing it longer than the Curtis has been in the industry. So I don't every substantive questions that that I need to ask Curtis. Okay, and your summary is that you're just not a big fan of what he's promoting and he's kind of got two things. There's some people that promote this, but they're not good marketers. And so they can kind of skate under the radar for a while because they're just meeting individual people and you kind of roll your eyes when you see some of what they're promoting, but it's not like they're all over. The Curtis's biggest blessing was potentially not such a blessing in disguise because he blew up on TikTok over a million subs on TikTok and has people on YouTube and books. And so he's promoting all this, which creates a bigger target, which is just exposes or amplifies or uses word leverage his message out. And that can be awesome, but that also can be not so awesome if people on the other end don't appreciate that message. And it's essentially your alleging, it doesn't say this in the in the document, but probably that that person that felt like they didn't they they funded the $4,000 premium. They funded premiums on their kids. It wasn't they didn't have the money to fund. They felt like it was misleading, probably talked to an agent agent help complain on behalf of that client. And and then that and then the state of Washington sent that letter is that I mean that obviously that may or may not be the truth, but that's that's the you know the thing that kind of brought this to the to the forefront and you're you're under the opinion where it's like, hey, I hope I hope he stops his ultimate strategy because it's the marketing is the what it's experiencing. It's the what's exposing it, but the all what he's still teaching to this day, you're not a fan of and I think you've been pretty clear in this video in the video that we took down you're pretty clear that you're not a fan and that is something that is something that aged pretty well. Yeah, that's right. Well, yeah, right. That's always fun. Well, I've been warning me in just for a long time and have something happen with it, but you could ask other questions like, you know, is any other Department of insurance contact to you. You could ask us specifically what happened to this lady. Did she get her money back? Did she end up suing you? How many other client you could ask all sorts of questions? I don't know that that's the kind of inquiry you want to do with them. How many other losses have you had or how many losses have you had? How many clients to end up having this blow up? I mean, whether you're going to get truthful answers now. Yeah, no, it's not that you're going to be able to fact check. So that's why. Yeah, that's what you be careful with these kind of interviews because it gets on the web. Then he gives his opinion and then you can't fact check it. Although, you know, ultimately, while it's typically do come down on people like this. Yeah, and then you find them then you do the then you do the fact check video. But you know, my opinion of given Curtis a forum to you. Yeah, yeah. Yeah, yeah, just to be clear, Rocky was not the one who came up with the idea to have Curtis back on. Here's the way that I that I see it and I shared this in the video. I know that you haven't seen the video yet because of when we're recording this. But I welcomed Curtis to have a dialogue. And I think that our audience is smart enough to be able to see intent. And I have no idea what is going to be said, but there I've been really clear where my stance is. And we've kind of shared and I would much rather have a conversation versus having attorneys or having letters. And so one of the questions I will ask him is why this was sent. And if he regrets that or what what is thoughts around that is. And so we'll see where that goes. But Rocky, I appreciate even though I didn't vote for him. I appreciate I appreciate you and I also look forward to the other videos that we're doing. And I'm just I'm just excited to get more content with people that me you know you and I don't agree on everything. And I think it's awesome to have a platform to be able to expose really good ideas, talk about things and really elevate financial IQ. And so we'll have links down below. If you want to learn more about Rocky, what he's up to, we'll have links there. But most importantly, if you want to follow along with those documents, you'll be able to have that chance and make sure to subscribe and leave your thoughts and comments. We read every single comment. And also if you have video ideas or like, hey, I would love for you. You guys to make a video around this. Please let us know if you're not subscribed to Rocky's email newsletter and your advisor. Make sure to do that. And we will see you next time. Thank you.