Inheritance Tax vs. Estate Tax: What's the Difference and How to Prepare

Estate planning encompasses two confusing aspects which create substantial misunderstanding between inheritance tax and estate tax. Estate tax and inheritance tax run during asset transfers following death yet work differently and trigger different impacts on recipients. This complete guide defines key tax distinctions and presents methods to reduce their impact on your legacy.

Understanding Estate Tax: The "Death Tax"

Estate tax functions as the federal tax enforcement system that taxes the transfer of deceased assets to receive heirs. The tax has gained its nickname as the "death tax" and determines the value of property owned by a deceased person before beneficiary distributions.

Key Characteristics of Estate Tax

- Responsibility: Before distributing property to heirs the estate must cover its tax expense to the federal government.

- Federal Threshold: In 2025 estate taxes apply to estates worth more than $13.61 million for single people or exceeding $27.22 million for couples together. Federal estate taxes do not apply to estates below $13.61 million per person or $27.22 million for married couples during the 2025 period.

- Tax Rate: Estate tax rates enforced by the federal government progress based on value until they reach 40% which matches with amounts beyond the set exemption level.

- Filing Requirements: When the gross estate value surpasses the exemption threshold (Form 706) allows estates to file taxes within nine months after the decedent's death.

State-Level Estate Taxes

The extensive exemption at the federal level for estate tax hits a small percentage of Americans but numerous states enforce estate taxes which lock in lower thresholds of exemption.

- Twelve states and the District of Columbia plan to implement estate taxes beginning in 2025.

- State estate tax exemptions exist between $1 million and $7 million in value

- Estate taxes administered by states require payments between 10% and 20% of the estate value.

Understanding Inheritance Tax: The Beneficiary's Burden

The tax structure of inheritance differs from that of estate tax because the government collects this tax from individuals who inherit property from someone else's estate. The government at state level collects this tax which operates independently of federal government regulations with ample variations between states based on your place of residence.

Key Characteristics of Inheritance Tax

- Responsibility: All payments made to inherit assets are collected directly from each beneficiary who receives asset share, rather than going through the estate.

- State-Level Only: The federal government does not impose inheritance taxes; Six states currently maintain inheritance tax programs while the United States government does not enforce any tax on inherited properties. This taxation responsibility rests with the state governments of Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania.

- Variable Rates: Tax rates adjust according to the deceased's relations with beneficiaries and total value of their inherited property.

- Exemptions Based on Relationship: The majority of states under inheritance tax rules permit spouses to inherit without duties and several offer partial exemptions to direct family members.

Each state determines its own inheritance tax ranges and allowable exclusions which can vary according to blood ties

Every state that enforces inheritance taxes operates under individual rules that determine both exemption thresholds and taxation rates.

State-Specific Inheritance Tax Policies

- Maryland: The law offers complete tax exemption for spouses and children and parents and siblings. Other beneficiaries face a 10% tax.

- Nebraska: Spouses are exempt; Family inheritance tax rates vary by relationship: spouses remain untouched but immediate family members pay between 1% to 13% and distance relatives pay up to 18%.

- Kentucky: Spouses, parents, children, and siblings are typically exempt; Most state inheritance laws free spouses and parents from taxes but other genealogical relations pay between 4% and 16%.

- Iowa: Spouses and linear descendants are exempt; People who inherit from spouses or linear descendants are tax-free while others must pay between 5% and 15% inheritance tax.

- Pennsylvania: Spouses are exempt; The distribution of estate assets follows these tax rules: Spouses pay nothing while direct descendants must pay 4.5% and siblings must pay 12% and all other relatives will need to pay 15%.

- New Jersey: Spouses, parents, children, and grandchildren are exempt; Rates between 4% and 16% apply to other heirs whereas parents, siblings and their direct descendants are exempt from inheritances.

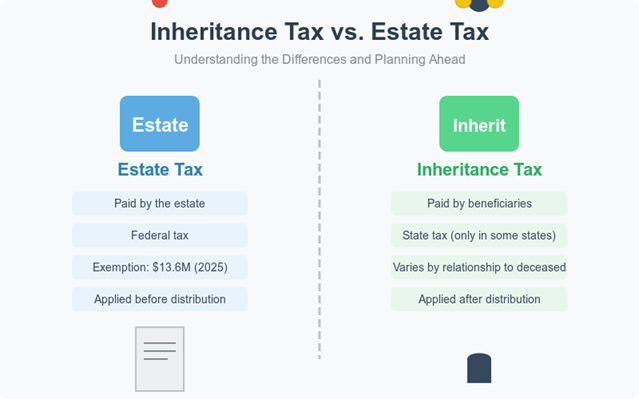

Key Differences Between Estate and Inheritance Taxes

Understanding the fundamental differences between these two types of taxes is essential for effective estate planning:

|

Feature |

Estate Tax |

Inheritance Tax |

|

Who pays |

The estate |

The beneficiary |

|

Who imposes |

Federal government and some states |

State governments only |

|

Calculation basis |

Total estate value |

Value of inheritance received |

|

Exemption based on |

Estate size |

Relationship to deceased |

|

Payment timing |

Before asset distribution |

After receiving inheritance |

Maryland’s Dual Taxation: Estate and Inheritance Taxes Explained

The estate has to pay estate tax on everything it holds.

After the estate administrator pays estate tax on the total assets the beneficiaries may be responsible for inheriting tax on their individual values.

The dual taxation system requires residents of such states to develop extensive estate plans.

Estate Planning Strategies to Minimize Tax Impact on Beneficiaries

1. Utilize Lifetime Gift Exemptions

The federal gift tax accepts the same annual exemption allocation as the estate tax regulations. Using targeted lifetime gift giving allows you to minimize your taxable estate without triggering gift tax obligations.

- Annual gift tax exclusion: $18,000 per recipient for 2025

- You can make unlimited tax-free gifts directly to educational institutions or medical facilities without limit.

2. Establish a Family Trust

Structured properly your family trust as it lets you avoid inheritance and estate taxation so you can efficiently transfer your wealth to your heirs.

The following advantages can be obtained from establishing a family trust:

- Trust assets escape the requirement of probate proceedings.

- Increased control over asset distribution

- Trust structures offer various tax-related benefits

- Your assets remain protected from creditor claims and legal judgements through this arrangement.

3. The implementation of Irrevocable Life Insurance Trusts (ILITs) should be considered by families.

By trusting ownership to an ILIT you can protect life insurance policy proceeds which will escape taxable estate rules.

- Life insurance proceeds generate funds that pay estate taxes

- Proper insurance structure protects beneficiaries from estate tax on policy proceeds received after the policyholder's death.

- Beneficiaries receive tax-free insurance benefits

4. Strategic Charitable Giving

Through philanthropic planning people can decrease their tax obligations while funding their favored charitable organizations:

- Through the mechanism of charitable remainder trusts you can receive lifetime income benefits and minimize estate tax exposure.

- Donor-advised funds enable donors to receive immediate tax deductions so they can distribute their donations as charity over time

- Donating directly to charities helps you lower your estate's taxable worth.

5. You should select home residence in a state that provides favorable tax structures.

Location determines how much inheritance and estate taxes residents need to pay:

- The majority of states today have eliminated all inheritance tax systems.

- States across the nation do not enforce estate taxes on inheritances.

- You should assess your home's tax consequences before deciding on retirement living arrangements or future residential relocation.

Special Considerations for Family Businesses

Family businesses frequently become central elements of estate assets so they generate significant tax implications.

Business Succession Planning

- Family Limited Partnerships (FLPs): Transition business assets at controlled periods for ongoing managerial control.

- Buy-Sell Agreements: The arrangements must protect business operations and supply funding to pay estate taxes.

- Special Use Valuation: Under Section 2032A of the Internal Revenue Code business owners who meet qualifying criteria can employ actual use valuation instead of making decisions according to maximum value potential.

Section 6166 Election

Through a Section 6166 Election qualifying estates can pay estate taxes linked to closely held businesses through installment payments extending over a maximum of 14 years which reduces immediate financial strain.

The Importance of Professional Guidance

Expert assistance becomes essential when dealing with complex estate and inheritance tax regulations.

- Estate Planning Attorney: Lawmakers establish framework to reduce the amount of taxes which can be imposed.

- Certified Financial Planner: Helps optimize overall financial strategy

- Certified Public Accountant: Their expertise includes both tax guidance and filing processes.

- Trust Officer: This professional handles trust assets through proper compliance diligence regarding trust terms.

Current Legislative Modifications Demonstrate New Directions for Estate Inheritances

The Tax Cuts and Jobs Act of 2017 introduced substantial estate tax exemption growth; however, this enhanced provision expires when 2025 ends and the exemption may drop to approximately $7 million per individual after inflation adjustments.

The engaged approach to estate planning becomes essential for estates within this $7 million to $13.61 million value range.

Every individual should possess specific estate planning documents

Estate planning starts with these foundation documents no matter the value of assets owned.

- Will: Through a will you can distribute your probate assets and choose guardians for your minor children.

- Revocable Living Trust: A person's assets remain under management through their lifetime until distribution happens after their death.

- Durable Power of Attorney: A person is chosen during estate planning to manage your finances in case of incapacity or disability

- Healthcare Directives: You must add healthcare power of attorney along with a living will

- Beneficiary Designations: Make sure retirement accounts along with life insurance policies go through proper transfer procedures

Conclusion: Proactive Planning is Key

Understanding the technical difference between inheritance tax and estate tax creates significant implications for your wealth transfer strategy. The limited reach of federal estate taxation applies to only select individuals yet statewide taxation requirements and potential coming regulatory shifts motivate active estate planning steps.

Through step-by-step tax-planning approaches consisting of strategic gifting and trust establishment alongside residential awareness you will protect your estate from taxation while securing substantial legacies for those you care about. Professional assistance from qualified experts leads to creating estate plans that address specific personal requirements to effectively handle complex tax implications.

Your estate plan's success depends on distributing assets by your wishes while keeping costs low and avoiding administrative complexities for your loved ones. Begin your planning journey today to secure your future inheritance for future generations.