What Is the Difference Between Term and Whole Life Insurance? A Comprehensive Guide

Life insurance is a crucial element of financial planning, but choosing the right type can be challenging. Two of the most popular options are term life insurance and whole life insurance. While both provide a death benefit to protect your loved ones, they differ significantly in structure, cost, and long-term benefits. In this guide, we’ll explore the key differences between term and whole life insurance, helping you understand which option may best suit your financial goals.

Term Life Insurance

Overview

Term life insurance offers coverage for a specific period—typically 10, 20, or 30 years. If you pass away during the term, your beneficiaries receive the death benefit. However, if you outlive the policy, it expires with no payout. Term life insurance is designed purely for protection without any cash value component.

Key Features

- Fixed Duration: Coverage lasts for a predetermined period. It’s often used to cover financial obligations that diminish over time, such as a mortgage or education expenses.

- Affordability: Because it provides pure protection and does not accumulate cash value, term life insurance premiums are generally much lower than those for permanent policies. For example, a healthy 30-year-old non-smoker might pay only a fraction of what they would pay for a whole life policy offering the same death benefit.

- Simplicity: Term life insurance is straightforward with no investment component. There’s little complexity in understanding the policy, making it an attractive option for individuals who want clear, simple protection.

Considerations

Term life insurance does not build cash value. Once the term expires, there is no residual value or savings component. For those who outlive the policy, coverage ends, and if additional protection is needed later in life, new policies might be more expensive due to age or changes in health.

For additional details on term life insurance, the Insurance Information Institute (III) offers clear insights and explanations.

Whole Life Insurance

Overview

Whole life insurance is a form of permanent life insurance that provides coverage for your entire life as long as premiums are paid. It not only offers a death benefit but also builds cash value over time. This cash value grows on a tax-deferred basis, meaning you don’t pay taxes on the growth until you access it.

Key Features

- Lifelong Coverage: Whole life insurance guarantees coverage for your lifetime, providing long-term security and peace of mind.

- Cash Value Component: A portion of your premium contributes to a cash value account. Over time, this account grows through compound interest and may even earn dividends. The accumulated cash value can be accessed through policy loans or withdrawals, providing flexibility for various financial needs.

- Fixed Premiums: Most whole life policies offer fixed premiums, which means you pay the same amount throughout the life of the policy, allowing for predictable budgeting.

- Tax Advantages: The cash value in a whole life policy grows tax-deferred, and the death benefit is generally paid tax-free to beneficiaries. For more information, see the IRS guidelines on life insurance.

Considerations

Whole life insurance is more expensive than term life insurance due to the added cash value feature and lifelong coverage. The higher premiums can be a drawback if your primary need is short-term protection. Additionally, the complexity of whole life insurance may require guidance from a financial advisor to ensure you fully understand the policy’s mechanics and costs.

The American Council of Life Insurers (ACLI) provides comprehensive resources on the benefits and structure of whole life policies, which can help you weigh these factors against your financial objectives.

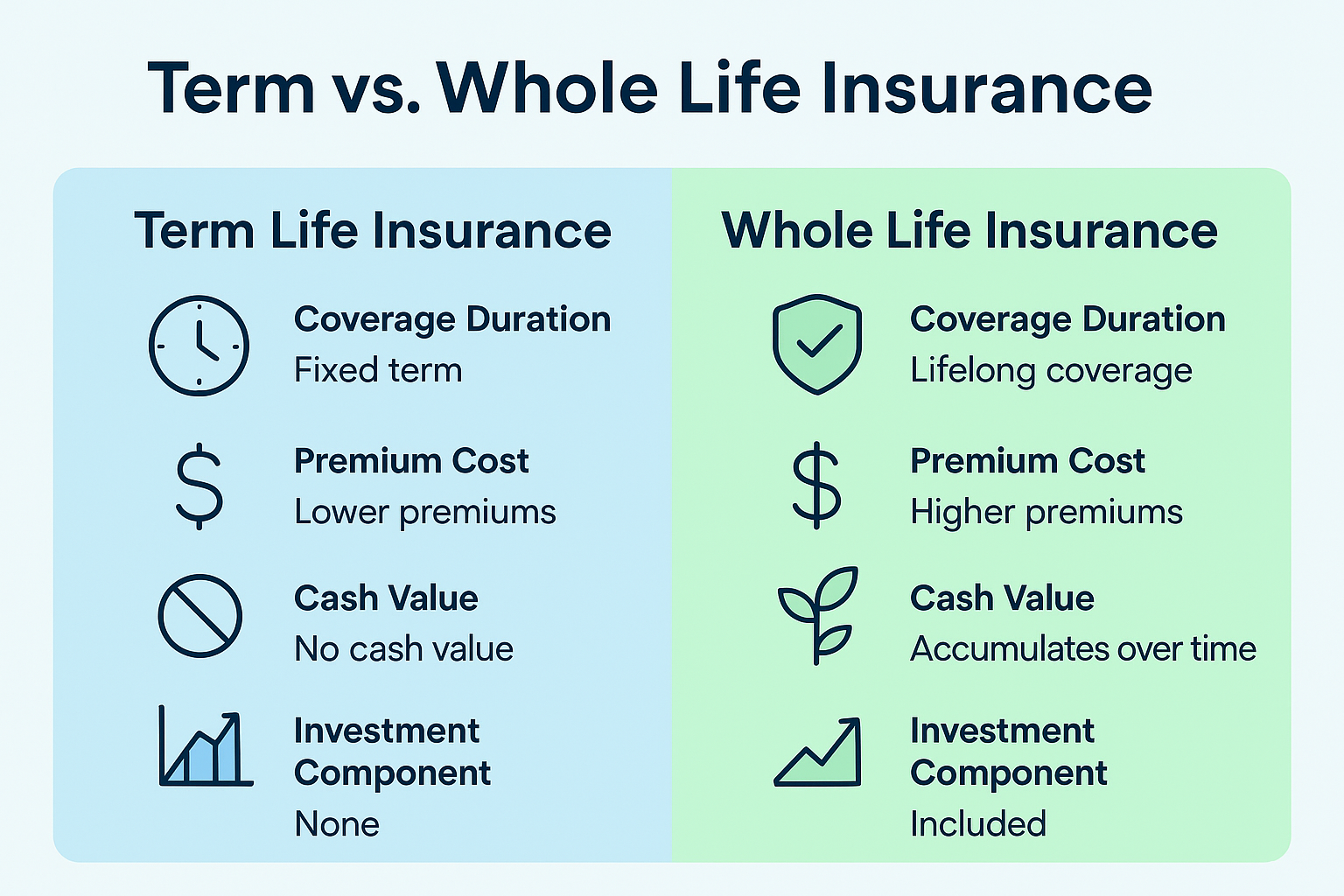

Comparing Term and Whole Life Insurance

Coverage Duration

- Term Life Insurance: Offers protection for a fixed term. If you outlive the term, the policy expires without any residual value.

- Whole Life Insurance: Provides lifelong coverage, ensuring that your beneficiaries receive a death benefit regardless of when you pass away.

Premium Costs

- Term Life Insurance: Generally has lower premiums because it offers no cash value accumulation.

- Whole Life Insurance: Premiums are higher due to the dual benefit of lifelong coverage and cash value growth.

Cash Value Accumulation

- Term Life Insurance: Does not build cash value; it’s purely for protection.

- Whole Life Insurance: Builds cash value over time, which can serve as a financial asset for future needs, such as supplemental retirement income or emergency funds.

Flexibility and Investment Component

- Term Life Insurance: Straightforward with a focus on protection. There is no investment component.

- Whole Life Insurance: Acts as both protection and an investment vehicle. The cash value component, which grows on a tax-deferred basis, can be accessed during your lifetime.

Which Option Is Right for You?

The choice between term and whole life insurance depends on your individual circumstances and financial goals:

- Term Life Insurance:

Ideal for individuals seeking affordable, temporary coverage to protect dependents and cover short-term obligations. It is best suited for those with limited budgets or whose financial needs are expected to change over time. - Whole Life Insurance:

Suitable for individuals who want lifelong coverage with the added benefit of cash value accumulation. This option is particularly attractive for long-term financial planning, estate planning, and those who wish to leverage the cash value as a financial asset.

Before making a decision, it’s important to assess your personal situation, evaluate your financial obligations, and consider long-term goals. Consulting with a financial advisor can help you determine the most appropriate type of life insurance for your needs.

Conclusion

Understanding the difference between term and whole life insurance is essential for making an informed decision about your financial protection strategy. Term life insurance offers affordable, temporary coverage without an investment component, making it a great option for those with short-term needs. In contrast, whole life insurance provides lifelong coverage, builds cash value through compound interest, and offers tax advantages—making it a valuable tool for long-term planning and estate preservation.

For more detailed tools and resources on evaluating your life insurance needs, explore BetterWealth’s And Asset Vault, which offers policy calculators, courses, and audiobooks designed to help you understand life insurance as an asset.

By weighing the benefits and drawbacks of term and whole life insurance, you can choose the policy that best aligns with your financial goals—ensuring that your loved ones are protected while also building a secure financial future.