Exploring the Benefits of Front-Loading a Whole Life Insurance Policy

Front-loading offers incredible flexibility, early cash value, and numerous options for the future. Whether you're an entrepreneur, an investor, or someone looking to leverage life insurance in the best possible way, this strategy can be a game changer.

What is Front-Loading?

Front-loading a whole life insurance policy involves making a substantial initial premium payment beyond the minimum premium required in subsequent years. This injects a large amount of cash into the policy upfront, significantly enhancing its first-year cash value and providing greater liquidity early on. This is particularly advantageous for those wanting to get a lump sum into their policy’s cash value and borrow it back in short order.

Immediate cash value is a crucial benefit of overfunded life insurance. It allows policyholders to access funds early on without being locked into high annual contributions. This is particularly useful if you are uncertain about future cash flow but have a lump sum available now.

For example, if the regular annual premium is $10,000, anything above that in the first year is considered a front load. We often encourage that if you frontload a policy with “x1” in the first year, then “x2” in the second year should be at least 20% of “x1” to maintain maximum efficiency. Ergo, if you frontload $100,000, you should contribute $20,000/yr at a minimum to sustain good cash value growth over time. Doing anything less than 20% often does not lead to good long-term growth. However, doing more than 20% will accelerate the growth of that policy substantially.

Why Front-Loading is a Powerful Strategy

The power of front-loading lies in the early cash value it creates.

Typically, whole life insurance policies are known for slowly building cash value over time. However, by front-loading, you can accelerate this growth and access a significant portion of your cash value in the first year. This can be particularly useful if you have large sums of money sitting idle in a bank account or you're looking for a more efficient way to manage your savings.

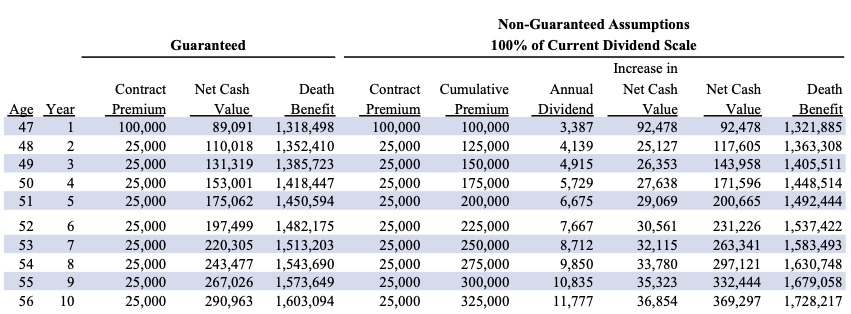

Here is an example policy for a 47-year-old male with a preferred health rating (see below). He asked us for a $100,000 frontload with a $25,000 annual premium. Notice the liquidity this creates in the first year; over 90% of the frontloaded amount is available in cash value in the first year! See the next cash value column on the far right. This type of design is highly dependent on your age and health rating. Your policy will likely have less initial liquidity if you are older or less healthy.

The History of Front-Loading

Front-loading isn’t just about dumping money into your policy; it requires a carefully structured design. The IRS knows that life insurance is a fantastic place to warehouse cash and never pay taxes on those dollars again. They even changed the laws in 1988 to limit the money paid into life insurance.

Before 1988, people could purchase single-premium, paid-up life insurance. They could place large amounts of money into a financial product that is never taxed again, grows competitively, and never relinquishes their control and access.

Like that kid on the playground who doesn’t know the meaning of “no” and always worms their way into everyone else’s games, the IRS said, “Nah, fam, Uncle Sam would like some of that dough!” So, the laws were changed, and a new limitation on how life insurance policies could be funded was established. This new guideline was called the 7-pay MEC test.

Important side note: The upcoming presidential election has significant implications for the taxation of life insurance and estate planning. See our recent video with NAIFA CEO Kevin Mayeux and a summary of the issues on the table. Just like in 1988, the focus is on the ultra-wealthy, but the changes ended up affecting your family and mine - this has the potential to do the same.

In essence, the 7-pay test states that for a specific life insurance policy, you have to pay premiums for at least 7 years and purchase enough death benefits to be classified as life insurance. If either of these rules is violated, your policy and the taxation of those dollars change to a Modified Endowment Contract (MEC).

Since 1988, in order to get money into life insurance, we have had to evenly spread out the premiums OR buy enough cheap death benefit with term insurance to justify to the IRS that the premium we are paying is warranted. This second strategy can enable a frontload.

The Mechanics of Front-Loading

The key to a successfully designed frontloaded policy comes from two riders that are added to the base whole life insurance policy.

- Term Insurance: This is the most cost-effective way to inflate the death benefit to justify to the IRS that we are buying enough insurance to allow for the large front-loaded premium deposit.

- Paid Up Additions (PUA): Those “extra” dollars that you are frontloading into a life insurance policy have to go somewhere! The vast majority, over 90% in the example above, go into this rider. PUAs, when applied to a policy, actually buy more permanent death benefit. This is why you see the death benefit increase year to year (and the byproduct of a more permanent death benefit is cash value!)

Adding term insurance to inflate the death benefit for at least 7 years allows over $90,000 extra premium to be paid into PUAs, driving up the first-year cash value to over 90% in the first year, as can be seen in the example table.

Which Insurance Company to Choose for Frontloads?

So the question we often get is: “Which carrier is the best for Frontloads?!”

The short answer is that not every carrier can build these types of frontloads due to the types of term insurance riders offered by that carrier. In another blog, we will go into the three types of term insurance riders that can be added to whole life: Level, blended, and annual renewable term. In most cases, only a level or annually renewable term rider will work for significant frontloads. At BetterWealth, we use four different carriers for frontloaded policies. Depending on the premium, underwriting or health concerns, long-term goals, or additional riders you are interested in, one carrier may be far better than the others.

Pro Tip: Work with an experienced insurance team with access to multiple high-quality carriers. One of the most popular carriers for frontloaded designs is highly conservative in its underwriting. Because of this, they often give out standard ratings when another carrier would give a higher health rating. For one of our clients, we pursued simultaneous applications with two insurance carriers for similarly designed frontloaded policies due to some minor health concerns she had. One carrier, the very popular and conservative one that the client wanted to apply to, returned with a standard health rating…, and the other returned with its highest health rating for the client. The difference in policy performance over 30 years was in the hundreds of thousands of dollars due to this rating difference. Both carriers are A+ rated or better and are substantial financial institutions. The insurance industry is fickle - work with an experienced insurance team with access to more than one carrier.

Pros and Cons of Front-Loading

Pros:

- Early Liquidity: One of the most significant advantages of front-loading is the ability to access a large portion of your cash value early on. This can be used for various purposes, such as investments, business expenses, or other financial needs.

- Flexible Contributions: After the initial front load, the ongoing contributions can be significantly lower, providing flexibility in your financial planning. Depending on how we build the policy, there can also be flexibility to pay up to the frontloaded amount in subsequent years if you want to.

- Accelerated Break-Even Point: By front-loading, you can reach the break-even point faster, meaning your cash value exceeds the premiums paid sooner than if you were funding with a cashflow model of the same dollar amount of premium every year.

Cons:

- Loss of Efficiency: Policies are maximally efficient when funded up to the annual payment limit. Since you are only planning on max funding for the first or the first couple of years in a front-load, you are buying more base and more term insurance to justify those early higher premiums. Those premiums, particularly the base premium, do not change for the life of the policy - which decreases the internal rate of return over time as compared to a cashflow (level funded) design.

- Complexity: Front-loading requires careful planning and understanding of the policy's structure, which is specific to every company. As outlined above, your case may be more unique than you think, and one size certainly does not fit all in the insurance industry.

- Company-Specific Rules: The benefits of front-loading can vary significantly depending on the insurance company. Some companies may impose restrictions or require higher base premiums, which could reduce the policy's overall efficiency. Some companies may even discourage this strategy if the goal is to leverage the cash value in the first year of the contract.

- Potential for MEC: If too much money is front-loaded, there’s a risk of the policy becoming a MEC, which changes many of the tax advantages of life insurance.

Conclusion

Front-loading a whole life insurance policy is a powerful strategy that can provide significant early cash value, flexibility, and the ability to leverage your policy for other financial goals. However, it’s essential to work with an experienced agent who understands the intricacies of this design and can tailor it to your specific needs.

If you want to explore how front-loading could benefit your financial strategy, we encourage you to contact us for a personalized consultation. Whether you're just starting or looking to optimize an existing policy, front-loading might be the key to unlocking the full potential of your whole life insurance.

Subscribe to receive the latest blog posts to your inbox every week.