Revocable vs. Irrevocable Trust: Understanding the Key Differences

BetterWealth

December 15, 2025

Selecting the right trust structure is a cornerstone of effective estate planning. Two of the most common vehicles are the revocable trust and the irrevocable trust. While they may sound similar, their legal characteristics, tax implications, and asset-protection benefits differ significantly. In this comprehensive guide, we’ll explore:

- Definitions and purposes of revocable and irrevocable trusts

- Key differences in control, flexibility, and taxation

- Pros and cons of each trust type

- Real-world scenarios for choosing one over the other

- Actionable steps to establish the right trust for your goals

What Is a Revocable Trust?

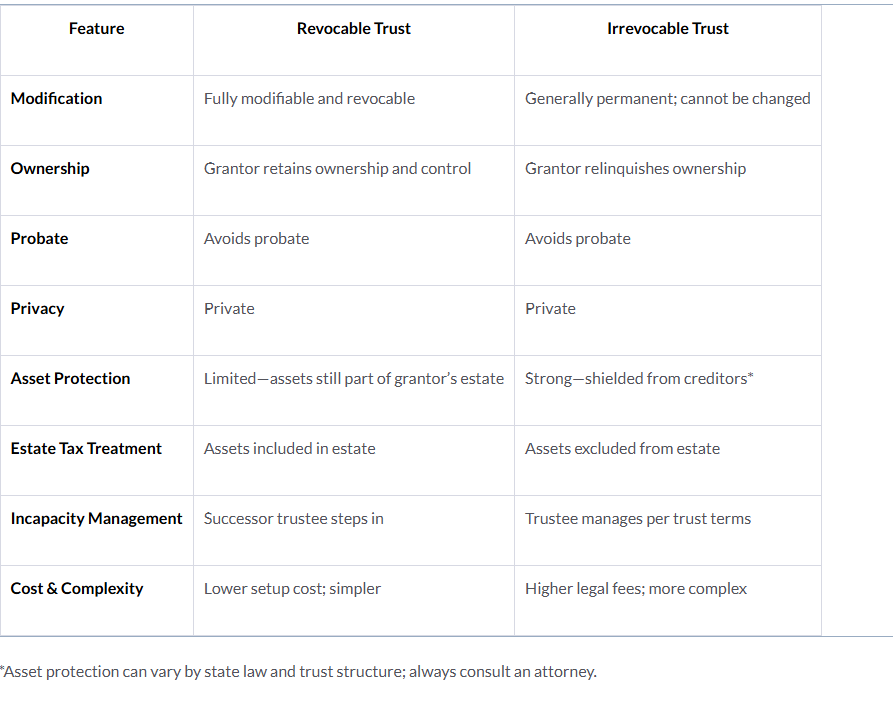

A revocable trust, often called a revocable living trust, is an estate planning tool you can modify, amend, or revoke at any time during your lifetime.

Key Features

- Flexibility: You retain the power to change beneficiaries, trustees, or distribution terms.

- Probate Avoidance: Assets held in the trust bypass probate, speeding up distribution and preserving privacy.

- Control: As the grantor, you remain in full control of trust assets and can even serve as trustee.

Common Uses

- Avoiding Probate: Ensures your heirs receive assets quickly without court involvement.

- Incapacity Planning: Allows a successor trustee to manage assets if you become incapacitated.

- Privacy: Trust terms remain private, unlike wills, which become public records upon probate.

What Is an Irrevocable Trust?

An irrevocable trust cannot be changed or revoked once established (except under very limited circumstances). Once you transfer assets into an irrevocable trust, you effectively remove your ownership rights.

Key Features

- Asset Protection: Creditors cannot access trust assets, since you no longer legally own them.

- Estate Tax Reduction: Assets outside your estate may reduce federal and state estate taxes.

- Limited Control: You relinquish control over the assets; a trustee manages them according to the trust terms.

Common Uses

- Medicaid Planning: Protects assets by transferring them out of your estate, potentially qualifying you for benefits.

- Estate Tax Mitigation: Helps wealthy individuals reduce estate taxes under current federal law (up to a $13.61 million exemption in 2024) .

- Specialized Purposes: Special needs trusts, life insurance trusts, or dynasty trusts.

Side-by-Side Comparison

Pros and Cons

Revocable Trust

Pros:

- Maximum flexibility and control

- Simplifies incapacity planning

- Avoids probate delays and costs

- Relatively low cost to establish

Cons:

- No asset protection—assets remain in your taxable estate

- Creditors may still access assets

- No tax-reduction benefits

Irrevocable Trust

Pros:

- Strong protection from creditors and lawsuits

- Potentially reduces estate tax liability

- Useful for specialized planning (e.g., Medicaid, special needs)

Cons:

- Loss of control—cannot amend or revoke easily

- Complex to set up and administer

- Irreversible transfer of assets

Real-World Scenarios

When to Choose a Revocable Trust

- You want control: You plan to revise asset distributions as family circumstances change.

- Incipient incapacity concerns: You need a seamless mechanism for a successor trustee to step in.

- Privacy priority: You prefer keeping your estate plan out of public probate records.

Case Study: Susan, age 60, with a blended family, needs flexibility to adjust inheritances to stepchildren over time. A revocable trust allows her to update beneficiaries as relationships evolve.

When to Choose an Irrevocable Trust

- Asset protection need: You’re a professional facing potential liability (e.g., physician, business owner).

- Estate tax mitigation: Your estate may exceed the federal exemption threshold when combined with other assets.

- Government-benefit qualification: You’re seeking Medicaid coverage and need to transfer assets without penalty.

Case Study: John, age 75, with a $5 million estate, transfers investments into an irrevocable trust to shelter assets from possible estate taxes and qualify for long-term care benefits.

How to Establish Your Trust

- Define Your Objectives: Determine whether flexibility (revocable) or protection (irrevocable) is your priority.

- Select a Trustee: Choose a trusted individual or corporate fiduciary experienced in trust administration.

- Draft the Trust Document: Work with an estate planning attorney to ensure compliance with state law and IRS regulations.

- Fund the Trust: Transfer titles of real estate, investment accounts, and other assets into the trust name.

- Review Regularly: Conduct periodic reviews—especially after marriage, divorce, births, or changes to tax laws.

Common Misconceptions

- “I can’t change an irrevocable trust.” Some jurisdictions allow limited modifications via court order or a trust protector provision.

- “Revocable trusts avoid all estate taxes.” Because assets remain in your taxable estate, revocable trusts offer no federal estate tax benefit.

- “Trusts are only for wealthy families.” Trusts can benefit estates of any size by avoiding probate and planning for incapacity.

Frequently Asked Questions

Q: Can I convert a revocable trust into an irrevocable trust?

A: Yes. Upon your passing, a revocable trust often “springs” into irrevocability. You can also amend the trust document during your lifetime to include an automatic conversion date.

Q: What happens if I move to another state?

A: Most trusts remain valid across states, but state-specific rules may affect administration. Consult your attorney if you relocate.

Q: How much does trust administration cost?

A: Costs vary by complexity, trustee fees, and state. Revocable trusts typically cost $1,000–$5,000 to set up; irrevocable trusts often range higher due to specialized drafting.

Conclusion

Choosing between a revocable trust and an irrevocable trust hinges on your need for flexibility versus asset protection. While revocable trusts offer control and probate avoidance, irrevocable trusts provide strong protection and potential tax benefits. By understanding their differences, weighing pros and cons, and aligning with your personal and financial goals, you can craft an estate plan that secures your legacy.

Next Steps:

- Outline your priorities—control or protection.

- Consult an experienced estate planning attorney to draft the appropriate trust.

- Fund your trust promptly and review periodically for changes.

Ready to build a trust that safeguards your assets and preserves your legacy? Schedule a call with our BetterWealth team for personalized estate planning guidance.

Sources & Further Reading

- IRS, “Estate and Gift Taxes”

- NAIC, “Trusts: Basics and Uses”

- BetterWealth, “Estate Planning Checklist” (2024)

.png)