Are you considering whole life insurance as part of your financial strategy in 2025? If so, you're not alone. Whole life insurance remains a popular, yet often misunderstood, financial tool. With many mixed opinions out there, it’s crucial to weigh the pros and cons thoroughly. In this comprehensive guide, I’ll dive deep into what makes whole life insurance worth considering in 2025, explain how it supports financial strategies like Infinite Banking, and share clear insights with the help of a detailed Whole Life Insurance Cash Value Chart.

What is Whole Life Insurance?

Whole life insurance, a type of permanent life insurance, provides lifelong coverage coupled with a cash value accumulation component. Unlike term life insurance—which only offers coverage for a specific period—whole life policies last your entire lifetime, provided premiums are paid.

When you purchase whole life insurance, you secure:

- Guaranteed death benefit

- Fixed premium payments

- Cash value growth that accumulates tax-deferred

How Does Whole Life Insurance Work?

Whole life insurance policies consist of two primary components:

- Death Benefit: A guaranteed sum paid tax-free to your beneficiaries upon your passing.

- Cash Value: An accumulated savings feature that grows steadily over time.

The cash value element distinguishes whole life from other insurance types, as it provides a built-in savings component you can leverage during your lifetime.

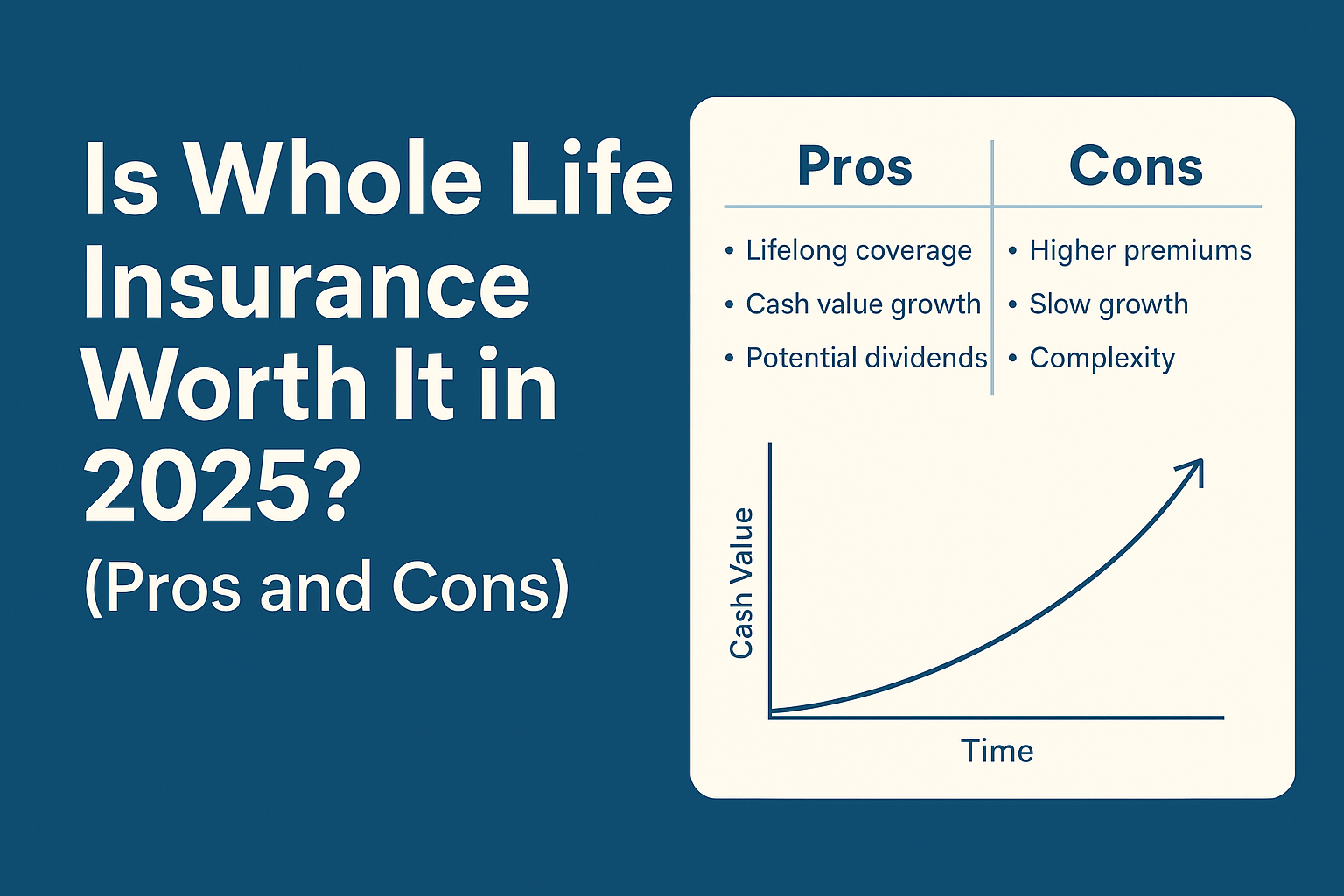

The Pros of Whole Life Insurance

Let's explore the advantages that make whole life insurance appealing to many individuals in 2025.

1. Lifelong Protection

One of the biggest advantages of whole life insurance is permanent protection. Unlike term life policies that expire after 10, 20, or 30 years, whole life policies remain active throughout your entire life, as long as you pay premiums.

2. Guaranteed Cash Value Growth

Your policy’s cash value grows at a guaranteed minimum interest rate, set by your insurance provider. This growth is not affected by market volatility, offering a safe, predictable way to build your savings.

Here’s an illustrative Whole Life Insurance Cash Value Chart example:

|

Policy Year |

Premiums Paid |

Guaranteed Cash Value |

|

5 |

$10,000 |

$4,200 |

|

10 |

$20,000 |

$11,000 |

|

20 |

$40,000 |

$27,000 |

|

30 |

$60,000 |

$50,000 |

Note: Values are illustrative and actual results may vary.

3. Tax Benefits

Whole life insurance provides several tax advantages:

- Tax-free death benefits: Beneficiaries typically receive payouts without income tax obligations (IRS Publication 525).

- Tax-deferred cash value growth: Your cash value grows tax-free until withdrawn.

4. Predictable Premiums

Premiums for whole life insurance are fixed for life. You won’t face unexpected increases, which can occur with renewable term policies.

5. Potential Dividends

Some whole life policies (participating policies) earn dividends from insurance company profits. While dividends aren't guaranteed, when received, they can:

- Reduce future premiums

- Increase your cash value

- Purchase additional coverage

6. Supports Infinite Banking Concept

Whole life insurance serves as the foundation for the Infinite Banking concept. Infinite Banking involves using your policy’s cash value as a personal banking system—borrowing from yourself to fund investments, purchases, or emergencies without traditional banks’ involvement.

Explore the Infinite Banking concept in detail using our resources at BetterWealth's And Asset Vault.

The Cons of Whole Life Insurance

Despite its benefits, whole life insurance also comes with some drawbacks you must consider.

1. Higher Premiums

Whole life insurance premiums are typically higher than term life premiums due to lifelong coverage and cash value benefits. If budget is a primary concern, term life may initially be more appealing.

2. Slower Cash Value Accumulation

Cash value accumulation in whole life policies can take several years before becoming significant. Early policy years often see minimal growth due to initial insurance and administrative costs.

3. Complexity

Whole life insurance policies can be complex. Understanding the details, including how cash values accumulate and how loans or withdrawals impact your policy, requires careful review and professional guidance.

4. Opportunity Cost

The conservative nature of whole life insurance cash value growth might yield lower returns compared to more aggressive investment vehicles like stocks or mutual funds. If your primary goal is maximum growth, other investments might outperform in the long run.

Whole Life Insurance in 2025: Is It Worth It?

Whether whole life insurance is worth it for you in 2025 largely depends on your financial goals and situation. Here are some considerations:

When Whole Life Insurance Makes Sense

- You seek lifelong insurance protection and financial stability.

- You value guaranteed cash value growth and predictable premiums.

- You are interested in using whole life insurance as a safe wealth-building vehicle or as part of the Infinite Banking concept.

- Estate planning and tax efficiency are priorities.

When Whole Life Insurance Might Not Make Sense

- You have short-term insurance needs.

- Your budget requires minimal premiums.

- You prioritize high-risk, high-reward investment strategies.

Actionable Steps for Deciding

Step 1: Define Your Financial Objectives

- Consider whether your goals align more with temporary protection (term life) or long-term wealth accumulation (whole life).

Step 2: Evaluate Your Budget

- Ensure you can comfortably pay the higher premiums associated with whole life insurance.

Step 3: Analyze Whole Life Policies

- Compare the best whole life insurance options available today. Tools like the ones offered in BetterWealth’s And Asset Vault can help you visualize and understand policies clearly.

Step 4: Consult a Financial Advisor

- Discuss your unique situation and financial goals with an advisor to gain personalized insights into whether whole life insurance suits you best.

Common Misconceptions

Misconception: "Whole life insurance is a poor investment."

Reality: Whole life insurance isn't purely an investment—it's a blend of insurance and savings designed to provide guaranteed returns and tax advantages, rather than speculative growth.

Misconception: "Term insurance is always better."

Reality: Term life insurance serves different purposes. It's excellent for temporary coverage needs, while whole life serves permanent, long-term goals.

Conclusion

In 2025, whole life insurance remains an attractive financial tool due to its permanent coverage, guaranteed growth, and strategic use in wealth-building strategies like Infinite Banking. However, it isn't ideal for everyone. Your financial objectives, budget constraints, and long-term plans should drive your decision.

To determine if whole life insurance aligns with your financial strategy, schedule a call with our BetterWealth team. Our expert advisors are here to help you make an informed decision tailored to your unique goals and needs.