When it comes to securing your financial future, life insurance stands as one of the most reliable and stable tools available. Specifically, whole life insurance provides lifelong coverage, cash value accumulation, and peace of mind knowing your loved ones are protected. However, understanding how whole life insurance rates change by age can significantly impact your financial planning and help you find the best whole life insurance for your unique situation.

In this detailed guide, we'll explore whole life insurance rates by age, provide relevant statistics, dispel common misconceptions, and help you determine if this type of insurance is right for you at different stages of your life.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance policy that provides coverage for your entire life as long as premiums are paid. Unlike term life insurance, which provides coverage for a specified period, whole life insurance combines a guaranteed death benefit with a cash value component that grows over time.

Here are the primary features of whole life insurance:

- Guaranteed Death Benefit: Your beneficiaries receive a tax-free death benefit upon your passing.

- Fixed Premiums: Premiums remain constant throughout the life of the policy.

- Cash Value Accumulation: A portion of your premiums contributes to a cash value that grows tax-deferred.

- Dividend Potential: Some policies pay dividends, which can increase your policy’s value or reduce premiums.

How Age Affects Whole Life Insurance Rates

Whole life insurance premiums are determined by several factors, primarily age, health, lifestyle, and policy size. Your age at the time you purchase your policy greatly impacts the cost of your premiums because insurance companies consider younger individuals less risky to insure due to their lower mortality rates.

According to the National Association of Insurance Commissioners (NAIC), premiums can dramatically increase as you age, so locking in a policy at a younger age can offer significant long-term savings.

Whole Life Insurance Rates By Age: A Breakdown

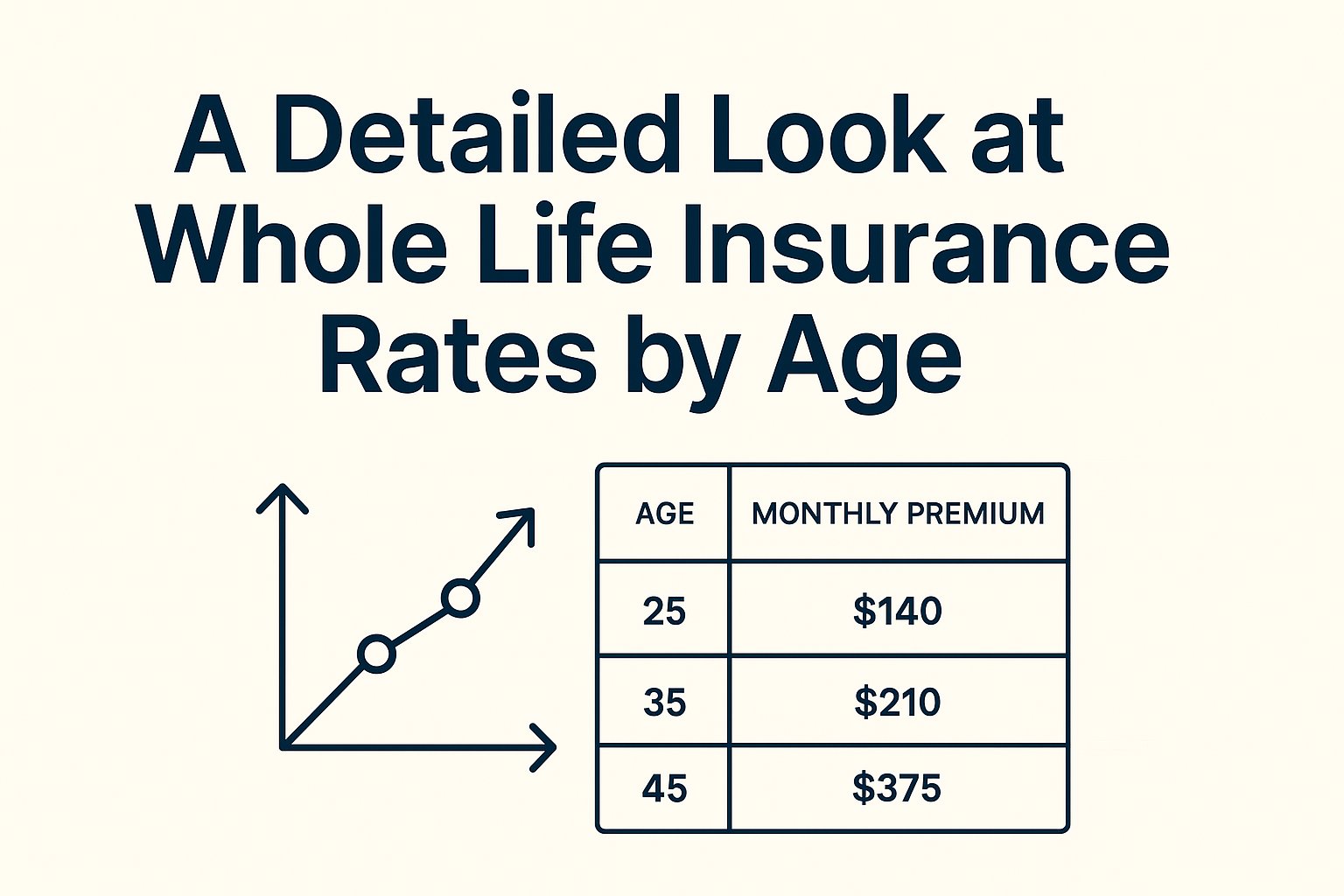

To illustrate how premiums change as you age, here’s a typical breakdown of average monthly rates for a $250,000 whole life insurance policy. Keep in mind these are average figures, and actual premiums may vary based on health, lifestyle, and insurance company specifics.

|

Age |

Average Monthly Premium |

|

25 |

$140 |

|

30 |

$165 |

|

35 |

$210 |

|

40 |

$290 |

|

45 |

$375 |

|

50 |

$500 |

|

55 |

$700 |

|

60 |

$970 |

|

65 |

$1,450 |

Source: Insurance Information Institute (III)

As seen, purchasing a policy at a younger age significantly reduces premium costs. For example, the cost difference between acquiring a policy at 30 versus 45 can equate to thousands of dollars over the policy's life.

Benefits of Purchasing Whole Life Insurance Early

1. Lower Premiums

By purchasing whole life insurance when you're younger, you'll benefit from lower premiums. These rates remain fixed for the duration of your policy, so buying early ensures that you pay the same affordable rate throughout your life.

2. More Time for Cash Value Accumulation

Starting a whole life policy earlier means your cash value component has more time to grow. The longer your policy remains active, the greater your accumulated cash value, enhancing financial flexibility and stability.

3. Easier Qualification

Younger applicants typically face fewer health issues and therefore find it easier to qualify for favorable rates.

For a deeper understanding of cash value accumulation, explore our resources on the BetterWealth And Asset Vault, which provides calculators, audiobooks, and courses designed to enhance your financial planning.

Common Misconceptions About Whole Life Insurance Rates by Age

Myth: "I Should Wait Until I'm Older to Buy Whole Life Insurance"

Reality: Delaying your policy purchase until you're older can result in substantially higher premiums. Securing a policy early not only ensures better rates but also maximizes cash value growth potential.

Myth: "Whole Life Insurance Is Too Expensive for Young People"

Reality: While initial premiums may seem higher than term insurance, the long-term value, cash accumulation, and guaranteed lifelong coverage often make it an economically sound decision, especially when purchased early.

Myth: "I Can Easily Change Policies Later if Needed"

Reality: Switching whole life policies later in life typically involves additional underwriting, higher premiums, and potential loss of previously accumulated cash value. Therefore, securing the right policy early is essential.

Factors Influencing Whole Life Insurance Rates

1. Health and Lifestyle

Insurers consider factors such as smoking, alcohol consumption, exercise, weight, and overall health. Leading a healthier lifestyle can significantly lower your premiums.

2. Occupation and Hobbies

Dangerous occupations or risky hobbies (like skydiving or scuba diving) can increase insurance premiums.

3. Policy Features

Certain riders or added features, such as accelerated death benefits or long-term care riders, can affect premiums.

4. Insurance Company

Rates vary significantly between insurance providers. Working with trusted advisors, such as our BetterWealth team, can ensure you find the best whole life insurance for your situation.

How to Find the Best Whole Life Insurance

Selecting the best whole life insurance involves careful consideration of several factors beyond just age:

Evaluate Your Needs and Goals

Understand your financial goals clearly—whether it's long-term savings, estate planning, or legacy building.

Compare Providers

Different insurance companies offer varying rates and policy features. Using a trusted resource like our advisors at BetterWealth ensures you receive personalized recommendations.

Review the Company's Financial Strength

Check insurer ratings through reputable agencies like A.M. Best or Standard & Poor's to ensure financial stability and reliability.

Understand the Cash Value Chart

Insurance companies provide a Whole Life Insurance Cash Value Chart to illustrate how cash value builds over time. Reviewing this chart helps you visualize potential growth and plan accordingly.

Visual Resources: Whole Life Insurance Cash Value Charts

An engaging visual such as a Whole Life Insurance Cash Value Chart can provide valuable insights into how your policy grows over time. This chart typically demonstrates:

- Initial premiums paid

- Guaranteed cash value accumulation over the years

- Projected dividends and their impact on total growth

Consider adding or referencing visual examples in your planning process. For real examples and interactive tools, use our BetterWealth Calculator.

Actionable Steps to Get Started with Whole Life Insurance

Step 1: Assess Your Financial Situation

Clearly outline your assets, debts, income, and financial goals to determine your insurance needs.

Step 2: Consult a Professional Advisor

Our BetterWealth team provides personalized guidance, ensuring your policy aligns with your long-term financial objectives.

Step 3: Review and Adjust Regularly

Life circumstances change, and your policy should evolve accordingly. Regular reviews help keep your plan relevant and effective.

Conclusion: Is Whole Life Insurance Right for You?

Whole life insurance can be a powerful tool for financial security, cash value growth, and legacy building, especially when started at a younger age. Understanding how premiums vary by age and how early investments compound into significant financial advantages is essential in determining the best whole life insurance for your unique situation.

If you're considering whole life insurance and want personalized insights, schedule a call with our BetterWealth team. We're dedicated to helping you achieve clarity and confidence in your financial journey.

Further Reading on the BetterWealth Blog:

- Whole Life vs Term Life Insurance: Which is Right for You?

- How to Utilize the Infinite Banking Concept with Whole Life Insurance

- Whole Life Insurance as an Investment Strategy for Millennials

Take control of your financial future today—your future self will thank you.