Get your free resources today!

Here’s what’s waiting for you:

Wealth Efficiency Packet – Think of your finances like a bucket—this guide helps you find and plug the leaks so you can optimize your money flow and build lasting wealth.

Tax Checklist – A strategic roadmap to legally minimize your tax burden and keep more money in your pocket.

Exclusive Education – Powerful calculators, books, and videos breaking down how life insurance and financial efficiency can work in your favor.

Tax Checklist & Wealth Efficiency Guide

Click the links below to download your free resources or keep scrolling to learn more and book a call.

- Tax Checklist: Gain valuable insights anytime, anywhere

- Wealth Efficiency Guide: Listen to easily digestible content, ideal for busy individuals

The And Asset Audiobook

Rather Listen than read? We're giving you The And Asset Audiobook... FOR FREE

- On-the-Go Learning: Gain valuable insights anytime, anywhere

- Engaging Content: Listen to easily digestible content, ideal for busy individuals

- Efficient Insights: Save time, absorb key insights, and maximize wealth strategies

The And Asset Calculator

Our one-of-a-kind calculator provides personalized estimates of the benefits you can gain with overfunded whole life insurance.

- Personalized Insights: Input your own numbers for customized estimates of potential cash value and benefits

- Visualize Wealth Growth: See a clear breakdown of how your wealth grows over time

- Compare Scenarios: Test different funding levels to understand the impact on your cash value and financial goals

The And Asset Crash Course

- Accelerated Learning: Gain essential insights in a condensed course for a comprehensive understanding

- Strategic Overview: Get a personalized overview of The And Asset's benefits and see why it is such a powerful tool

- Actionable Steps: Learn steps and strategies for leveraging this incredible wealth-building tool

- Gain Confidence: Feel empowered to take action in securing your financial future and achieving your goals

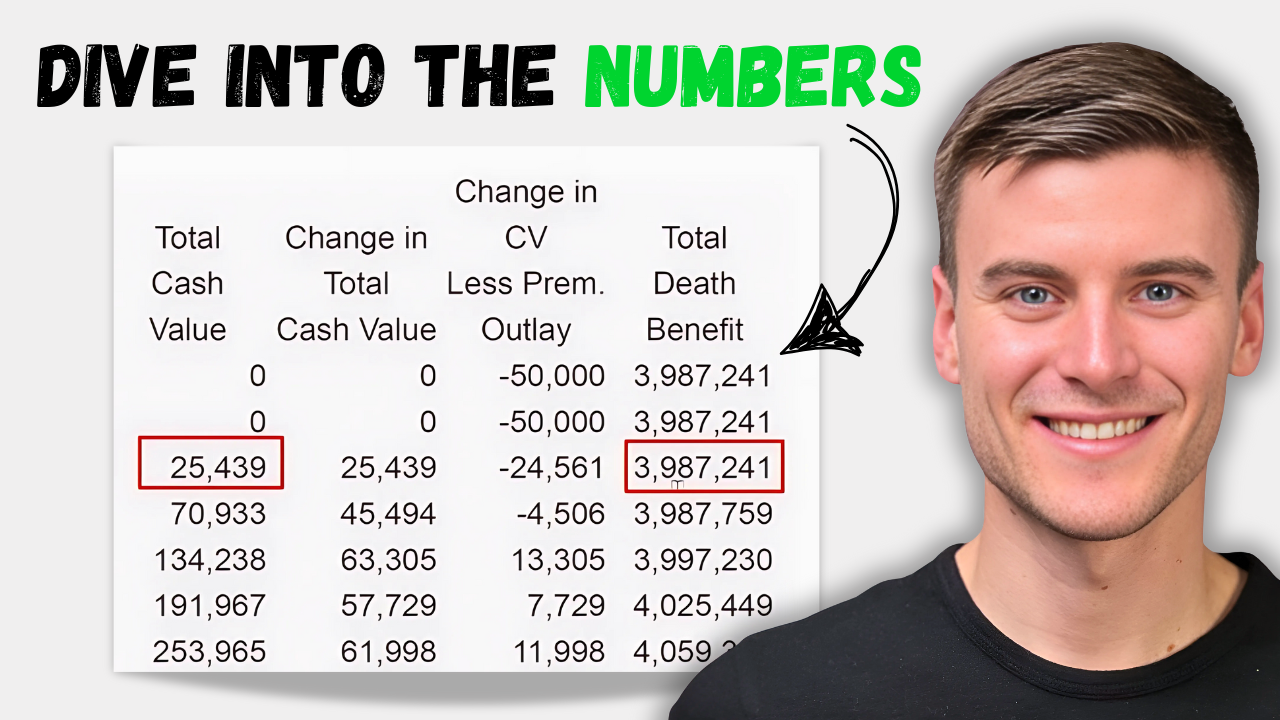

The Numbers Explained

- Traditional Vs Overfunded Whole Life: Gain insights into the differences between traditional and overfunded whole life insurance policies

- The Actual Returns (IRR): Dive into the actual returns, including Internal Rate of Return (IRR), on these policies to understand their financial impact

- Policy Numbers Breakdown: Learn about the components that make up the numbers of these policies, providing a comprehensive understanding of their structure and benefits